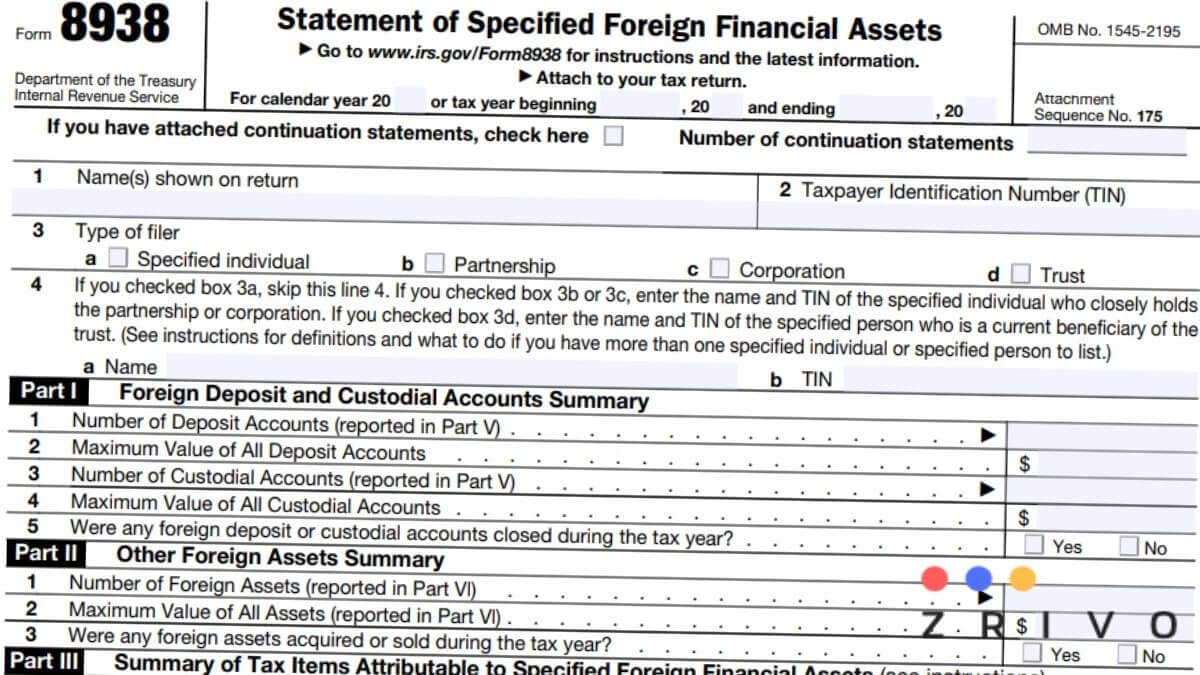

Form 8938 Æ›¸ÃÆ–¹ - If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. You do not need to. Form 8938 is used to report the taxpayer's specified foreign financial assets. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Tax system, especially for taxpayers who have. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 is filed if the taxpayer:

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Tax system, especially for taxpayers who have. Form 8938 is used to report the taxpayer's specified foreign financial assets. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. You do not need to. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Form 8938 is filed if the taxpayer:

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. You do not need to. Form 8938 is used to report the taxpayer's specified foreign financial assets. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938 is filed if the taxpayer: Tax system, especially for taxpayers who have. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed.

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

Form 8938 is filed if the taxpayer: Form 8938 is used to report the taxpayer's specified foreign financial assets. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s..

form 8938 vs fbar Fill Online, Printable, Fillable Blank form8938

Form 8938 is used to report the taxpayer's specified foreign financial assets. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 reporting applies for.

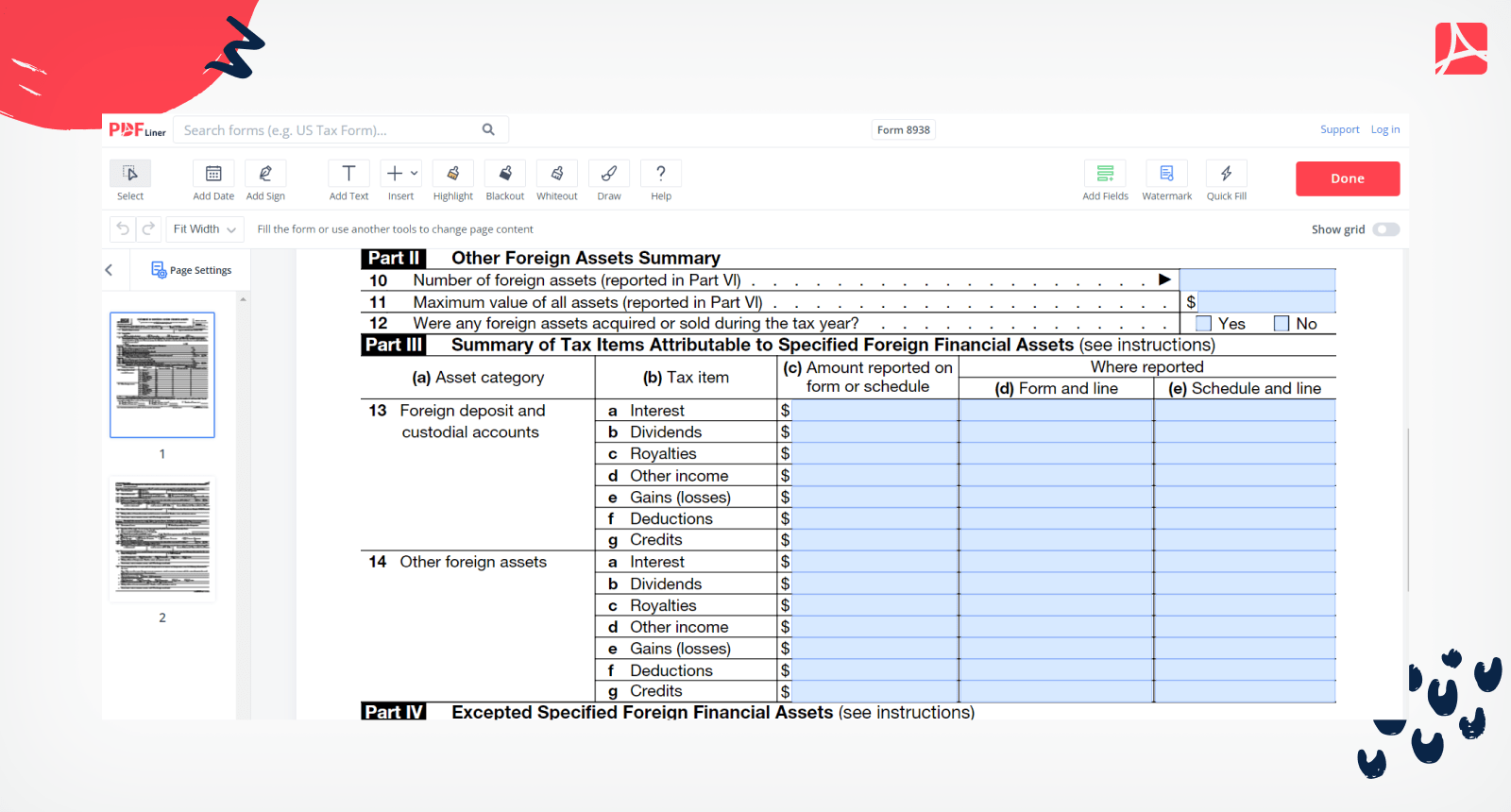

Form 8938 IRS Form 8938 Fillable and Printable blank PDFline

You do not need to. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Form 8938 is used to report the taxpayer's specified foreign financial assets. Use form 8938 to report your.

Form 8938 Instructions Do You Need to Report? GlobalBanks

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 is filed if the taxpayer: Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has.

Form 8938 2023 Printable Forms Free Online

If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Form 8938 is used to report the taxpayer's specified foreign financial assets. Tax system, especially for taxpayers who have. Form 8938 must be.

Form 8938 Blank Sample to Fill out Online in PDF

Tax system, especially for taxpayers who have. You do not need to. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Use form 8938 to report your specified foreign financial assets if.

Form 8938 Edit, Fill, Sign Online Handypdf

Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Form.

Form 8938 Filing Requirement Tax Strategies Motley Fool Community

You do not need to. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march. Use form 8938 to report your specified foreign financial assets if.

8938 Form 2021

You do not need to. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Tax system, especially for taxpayers who have. Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. Form 8938 is filed if the taxpayer:

Form 8938 Edit, Fill, Sign Online Handypdf

Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Form 8938 is used to report the taxpayer's specified foreign financial assets. Form 8938 reporting applies for.

Form 8938 Reporting Applies For Specified Foreign Financial Assets In Which The Taxpayer Has An Interest In Taxable Years Starting After March.

Form 8938 is filed if the taxpayer: Tax system, especially for taxpayers who have. Form 8938 must be filed by “specified individuals” with “specified foreign financial assets.” a specified individual is a u.s. Form 8938 is used to report the taxpayer's specified foreign financial assets.

You Do Not Need To.

Form 8938, statement of specified foreign financial assets, plays a crucial role in the u.s. If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you.