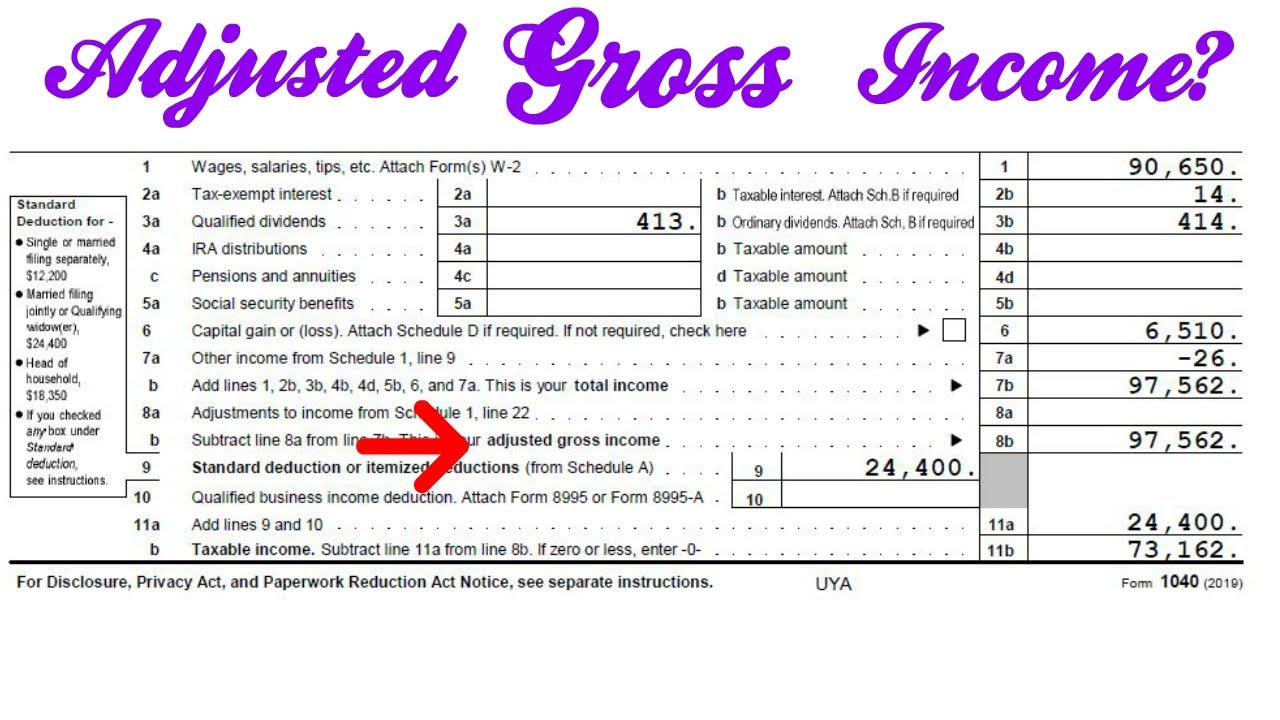

Adjusted Gross Income - Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate adjusted gross income (agi) for u.s.

Learn how to calculate adjusted gross income (agi) for u.s. Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible.

Learn how to calculate your adjusted gross income (agi) and modified adjusted. Learn how to calculate adjusted gross income (agi) for u.s. Agi is the total income you report minus specific deductions that you’re eligible.

What is Adjusted Gross Qualify for the Coronavirus Economic

Learn how to calculate adjusted gross income (agi) for u.s. Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible.

Modified Adjusted Gross under the Affordable Care Act UPDATED

Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate adjusted gross income (agi) for u.s.

You may want to read this about What Is An Adjusted Gross For Fafsa

Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate adjusted gross income (agi) for u.s.

What Is Modified Adjusted Gross For Medicare?

Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate adjusted gross income (agi) for u.s.

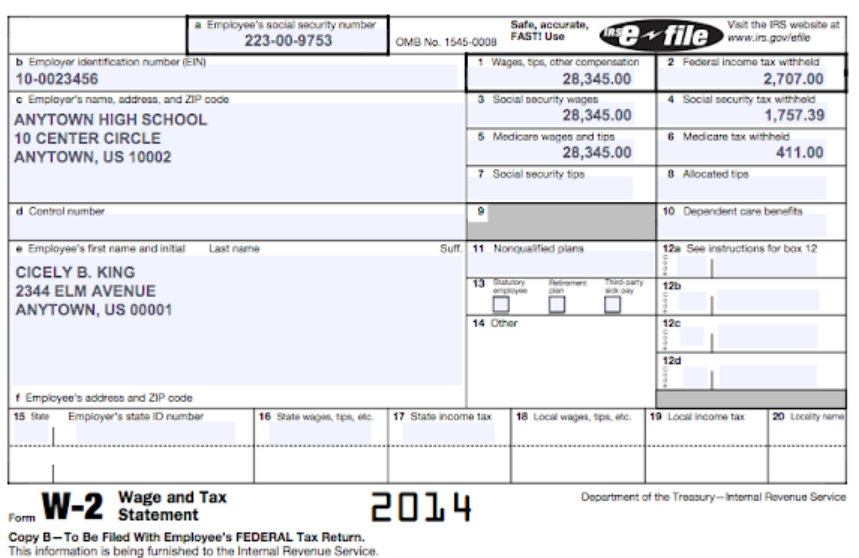

Adjusted gross on w2 cidad

Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate adjusted gross income (agi) for u.s.

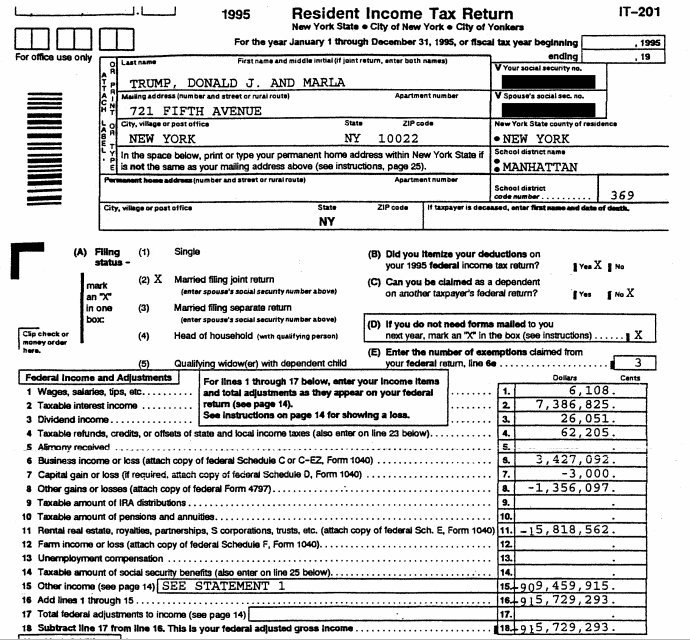

This is your federal adjusted gross 915,729,293

Learn how to calculate adjusted gross income (agi) for u.s. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate your adjusted gross income (agi) and modified adjusted.

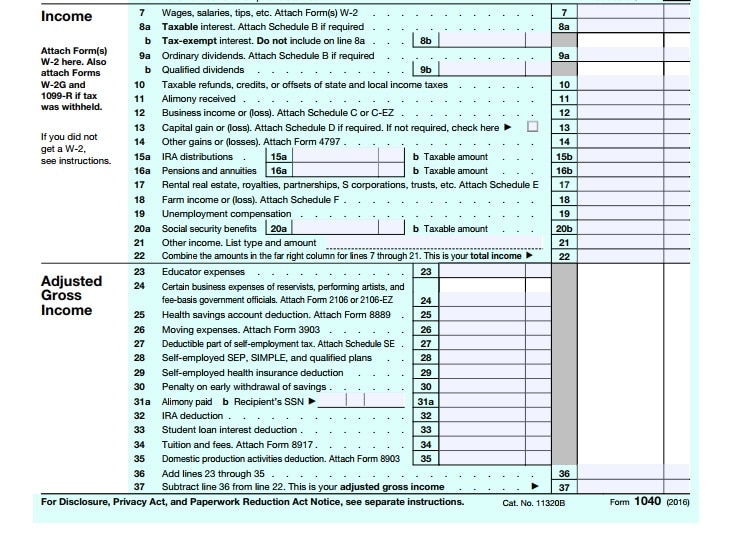

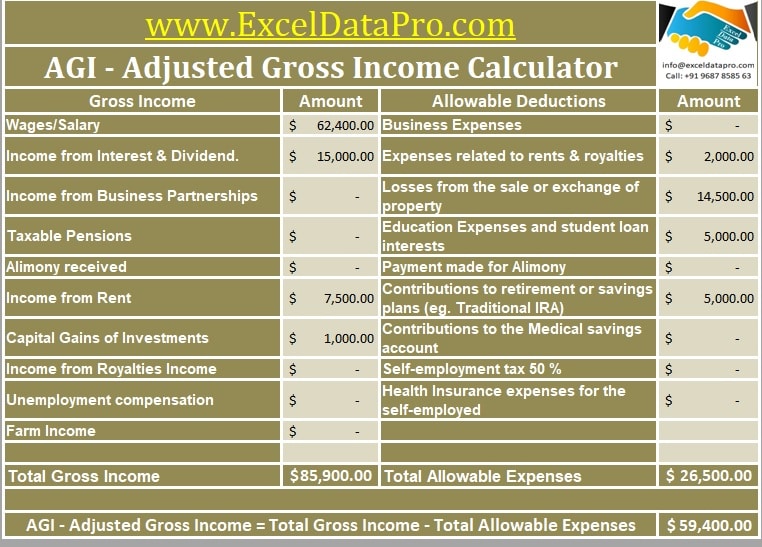

What is AGI Adjusted Gross ExcelDataPro

Learn how to calculate adjusted gross income (agi) for u.s. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate your adjusted gross income (agi) and modified adjusted.

Key Facts You Need to Know About Definitions for Marketplace and

Learn how to calculate your adjusted gross income (agi) and modified adjusted. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate adjusted gross income (agi) for u.s.

Download Modified Adjusted Gross Calculator Excel Template

Learn how to calculate adjusted gross income (agi) for u.s. Agi is the total income you report minus specific deductions that you’re eligible. Learn how to calculate your adjusted gross income (agi) and modified adjusted.

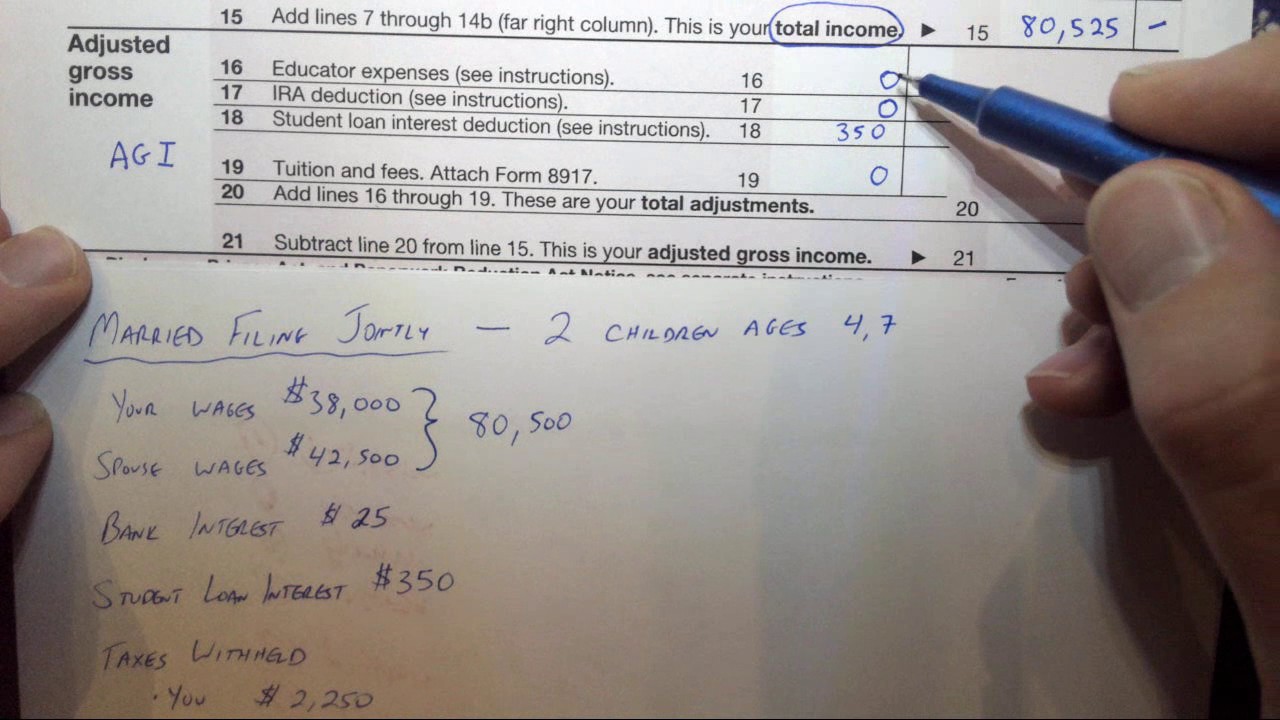

Agi Is The Total Income You Report Minus Specific Deductions That You’re Eligible.

Learn how to calculate your adjusted gross income (agi) and modified adjusted. Learn how to calculate adjusted gross income (agi) for u.s.