Amount Of Debt Discharged - However, there are some instances. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. A discharge of debt income occurs when a debt is forgiven by the person who lend the money.

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. However, there are some instances.

However, there are some instances. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. A discharge of debt income occurs when a debt is forgiven by the person who lend the money.

Solved Write a LC3 assembly program that contains a

However, there are some instances. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. This publication generally refers to debt that is canceled, forgiven, or discharged for.

Which Debts Are Discharged in Chapter 7 Bankruptcy? Best Bankruptcy

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. However, there are some instances. A discharge of debt income occurs when.

[Solved] Math 23. The principal P is borrowed at a simple interest rate

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. A discharge of debt income occurs when a debt is forgiven by.

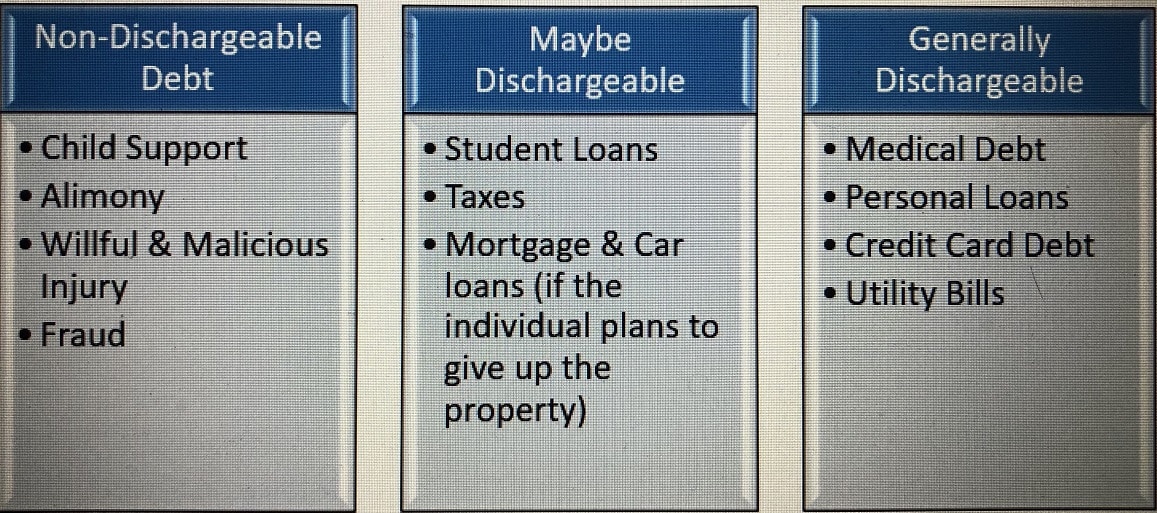

What Are The Dischargeable Debts In Bankruptcy?

However, there are some instances. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. This publication generally refers to debt that is canceled, forgiven, or discharged for.

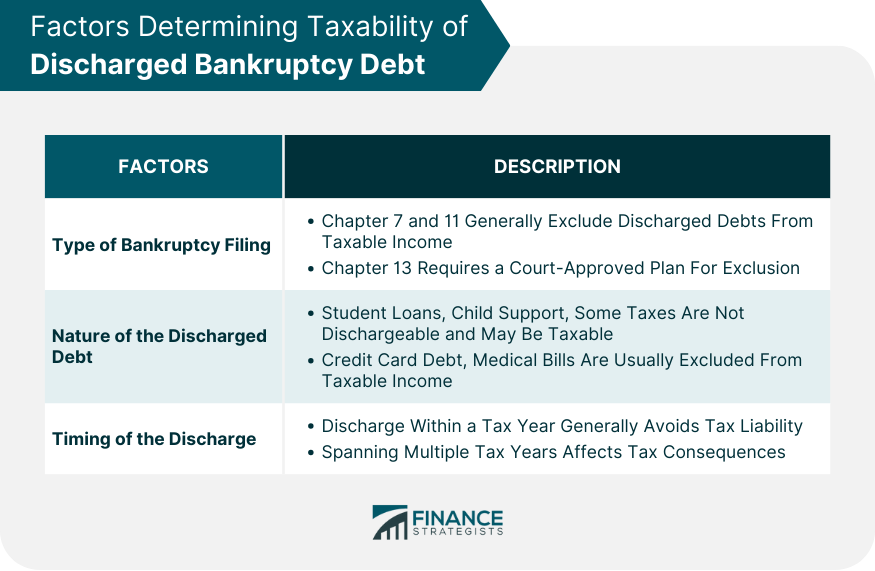

Do You Have to Pay Taxes on Discharged Bankruptcy Debt?

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. However, there are some instances. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. In general, if your debt is canceled, forgiven, or discharged for less than.

Debt Discharge What it is, How it Works

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. However, there are some instances. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. This publication generally refers to debt that is canceled, forgiven, or discharged for.

What Debt Cannot Be Discharged? Bruner Wright P.A

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. However, there are some instances. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. A discharge of debt income occurs when.

Should I Pay Off My Rental Mortgage? No Nonsense Landlord

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. However, there are some instances. This publication generally refers to debt that is canceled, forgiven, or discharged for.

Chapter 7 Bankruptcy 24 Hour Legal Advice Ask A Lawyer Live Chat

However, there are some instances. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. A discharge of debt income occurs when.

IRS Form 982 Instructions Discharge of Indebtedness

This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.”. However, there are some instances. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. In general, if your debt is canceled, forgiven, or discharged for less than.

This Publication Generally Refers To Debt That Is Canceled, Forgiven, Or Discharged For Less Than The Full Amount Of The Debt As “Canceled Debt.”.

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable. However, there are some instances.

:max_bytes(150000):strip_icc()/finalnew-cd2c2367ef8f4fcdaa1e9218acf86c9d.jpg)