California Form De9 - Find information and resources about required filings and due dates to help you follow. The employment development department (edd) provides quarterly contribution return and. You can visit online forms and publications for a complete list of edd forms available to view or. Learn how to adjust previously submitted reports, returns, or deposits made to the employment.

Find information and resources about required filings and due dates to help you follow. You can visit online forms and publications for a complete list of edd forms available to view or. Learn how to adjust previously submitted reports, returns, or deposits made to the employment. The employment development department (edd) provides quarterly contribution return and.

Find information and resources about required filings and due dates to help you follow. Learn how to adjust previously submitted reports, returns, or deposits made to the employment. The employment development department (edd) provides quarterly contribution return and. You can visit online forms and publications for a complete list of edd forms available to view or.

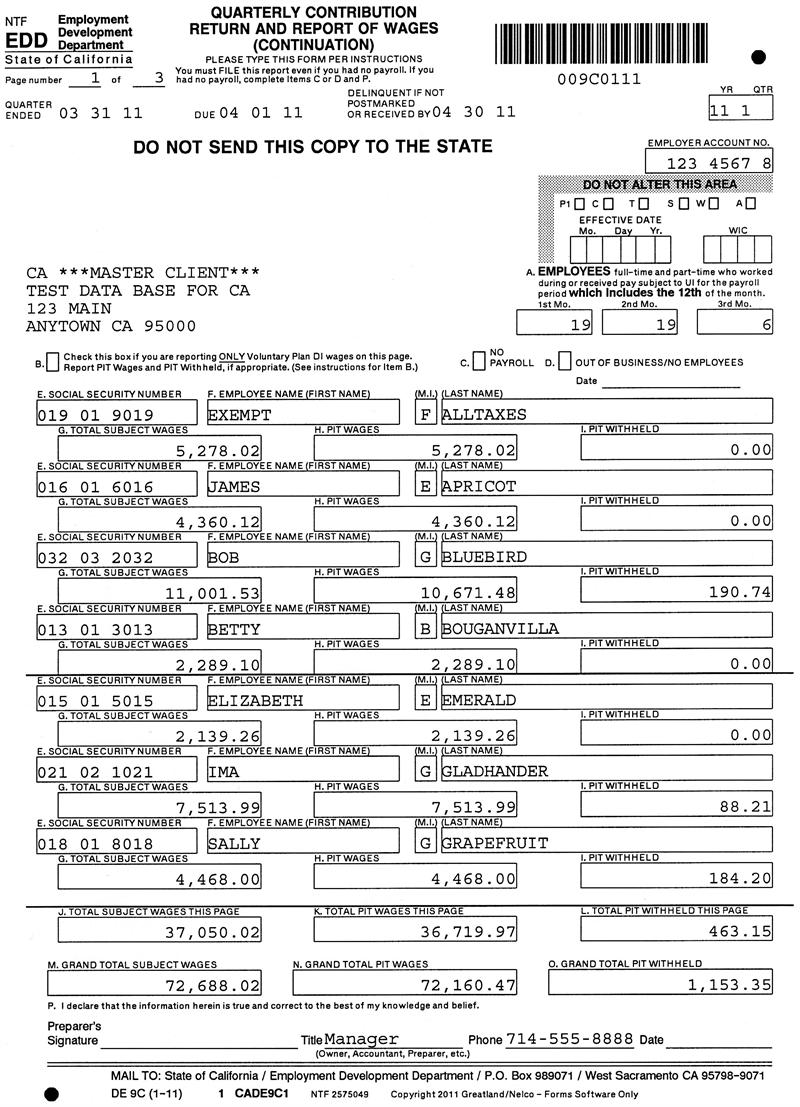

Edd instructions Fill out & sign online DocHub

Learn how to adjust previously submitted reports, returns, or deposits made to the employment. You can visit online forms and publications for a complete list of edd forms available to view or. Find information and resources about required filings and due dates to help you follow. The employment development department (edd) provides quarterly contribution return and.

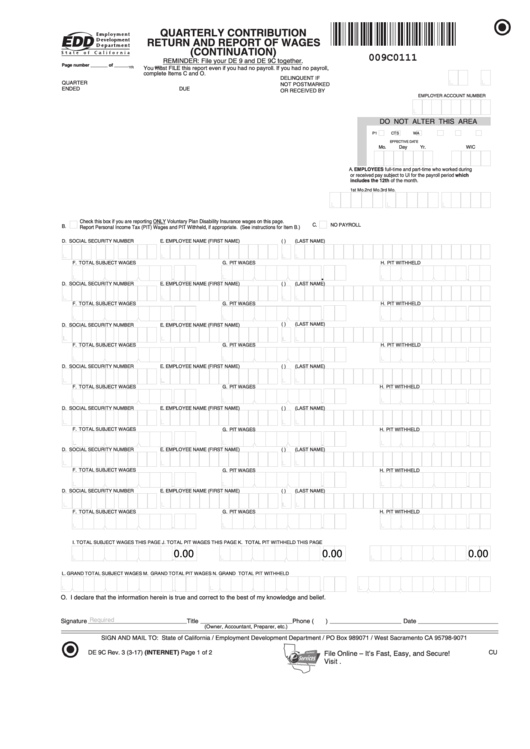

California DE 9 and DE 9C Fileable Reports

The employment development department (edd) provides quarterly contribution return and. Find information and resources about required filings and due dates to help you follow. You can visit online forms and publications for a complete list of edd forms available to view or. Learn how to adjust previously submitted reports, returns, or deposits made to the employment.

Fillable Online What is difference between de9 and de9c. What is

Find information and resources about required filings and due dates to help you follow. Learn how to adjust previously submitted reports, returns, or deposits made to the employment. You can visit online forms and publications for a complete list of edd forms available to view or. The employment development department (edd) provides quarterly contribution return and.

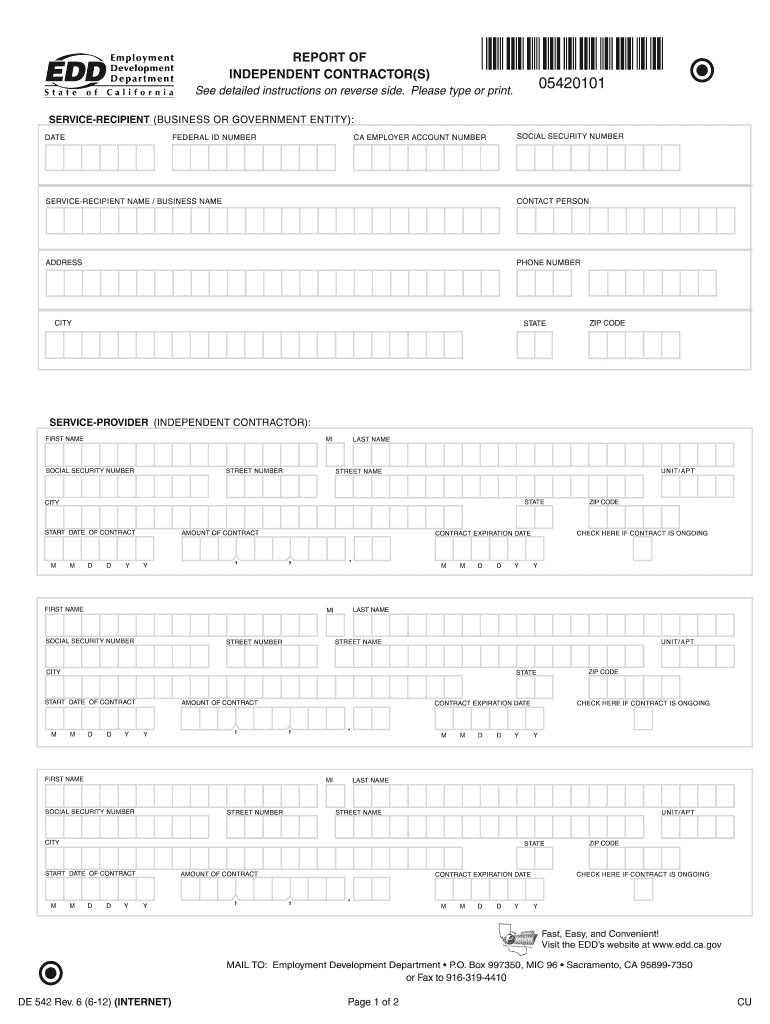

2012 Form CA DE 542 Fill Online, Printable, Fillable, Blank pdfFiller

You can visit online forms and publications for a complete list of edd forms available to view or. Learn how to adjust previously submitted reports, returns, or deposits made to the employment. Find information and resources about required filings and due dates to help you follow. The employment development department (edd) provides quarterly contribution return and.

California DE 9 and DE 9C Fileable Reports

Learn how to adjust previously submitted reports, returns, or deposits made to the employment. You can visit online forms and publications for a complete list of edd forms available to view or. The employment development department (edd) provides quarterly contribution return and. Find information and resources about required filings and due dates to help you follow.

De9 Form Fillable Printable Forms Free Online

You can visit online forms and publications for a complete list of edd forms available to view or. Learn how to adjust previously submitted reports, returns, or deposits made to the employment. Find information and resources about required filings and due dates to help you follow. The employment development department (edd) provides quarterly contribution return and.

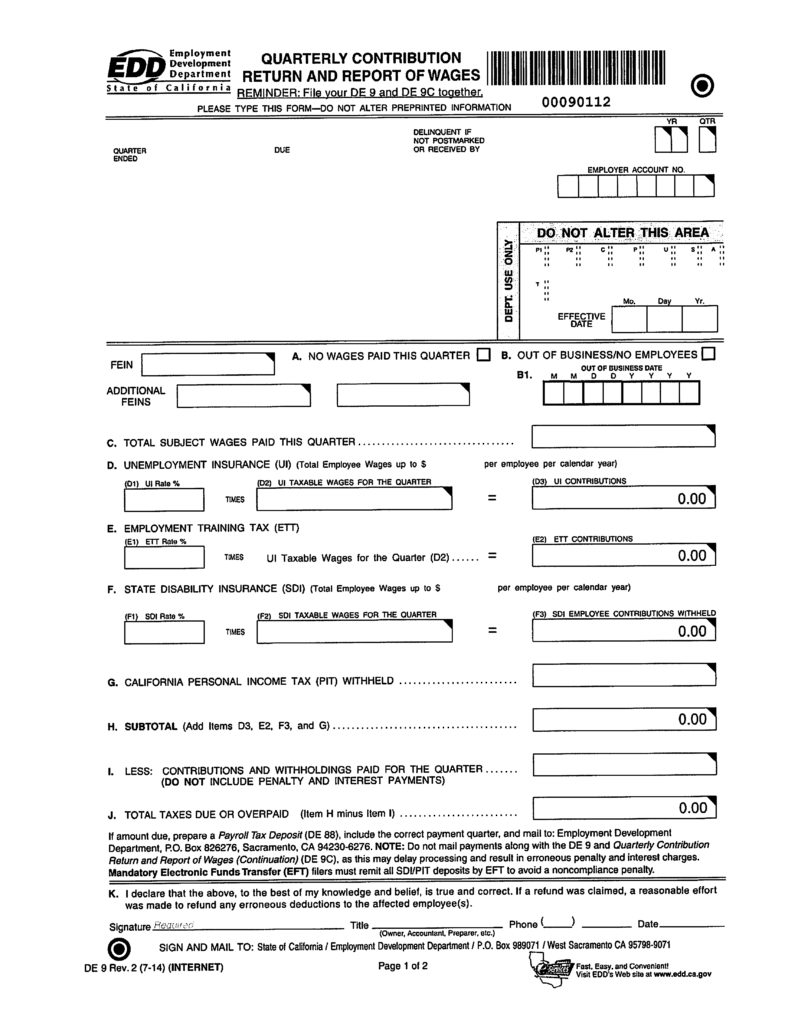

Quarterly Contribution Rerurn and Report of Wages, California Form DE9

Learn how to adjust previously submitted reports, returns, or deposits made to the employment. The employment development department (edd) provides quarterly contribution return and. Find information and resources about required filings and due dates to help you follow. You can visit online forms and publications for a complete list of edd forms available to view or.

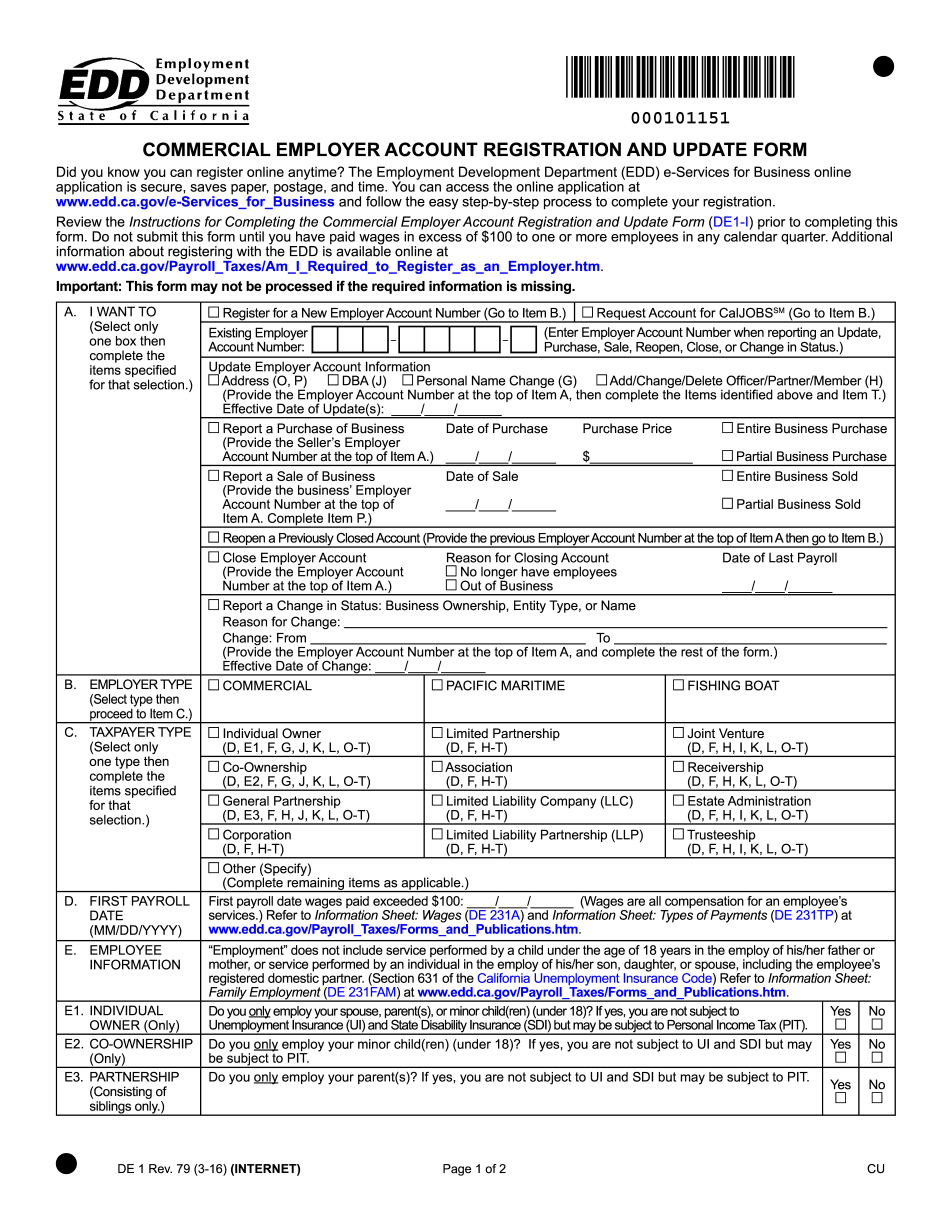

De1 California Registration Form for Commercial Employers in PDF

Learn how to adjust previously submitted reports, returns, or deposits made to the employment. The employment development department (edd) provides quarterly contribution return and. You can visit online forms and publications for a complete list of edd forms available to view or. Find information and resources about required filings and due dates to help you follow.

California Quarterly Contribution Report Wages Fill Online, Printable

Find information and resources about required filings and due dates to help you follow. The employment development department (edd) provides quarterly contribution return and. You can visit online forms and publications for a complete list of edd forms available to view or. Learn how to adjust previously submitted reports, returns, or deposits made to the employment.

Fillable Online Where to file form de9 and de9c. Where to file form de9

Find information and resources about required filings and due dates to help you follow. The employment development department (edd) provides quarterly contribution return and. You can visit online forms and publications for a complete list of edd forms available to view or. Learn how to adjust previously submitted reports, returns, or deposits made to the employment.

The Employment Development Department (Edd) Provides Quarterly Contribution Return And.

You can visit online forms and publications for a complete list of edd forms available to view or. Find information and resources about required filings and due dates to help you follow. Learn how to adjust previously submitted reports, returns, or deposits made to the employment.