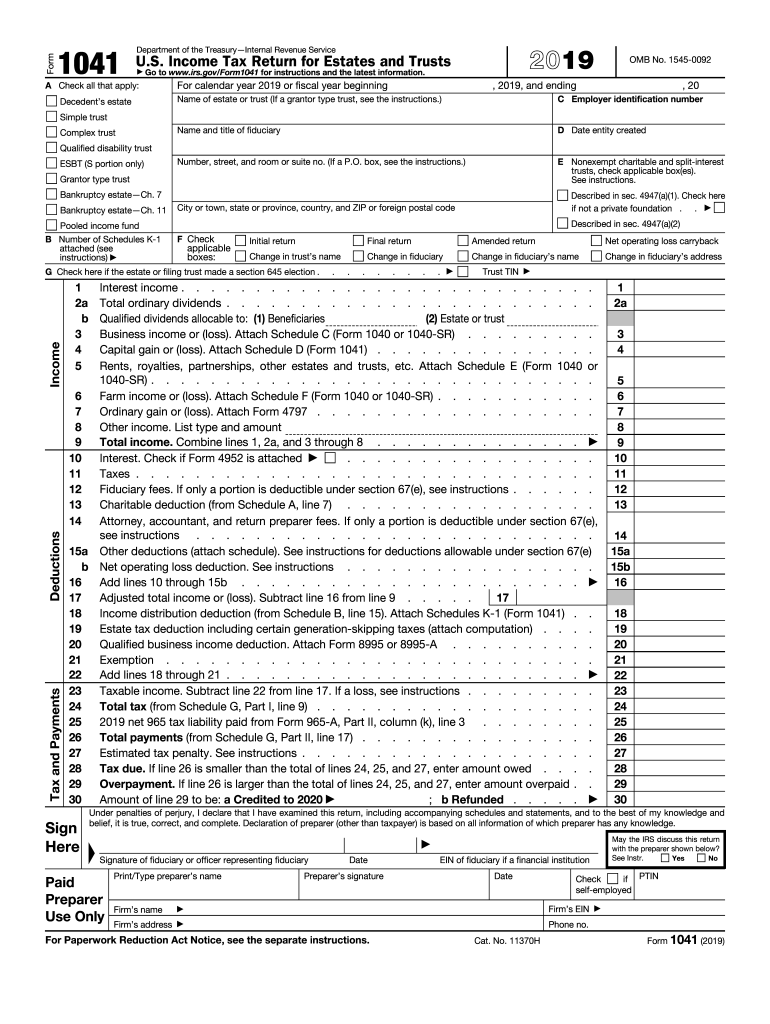

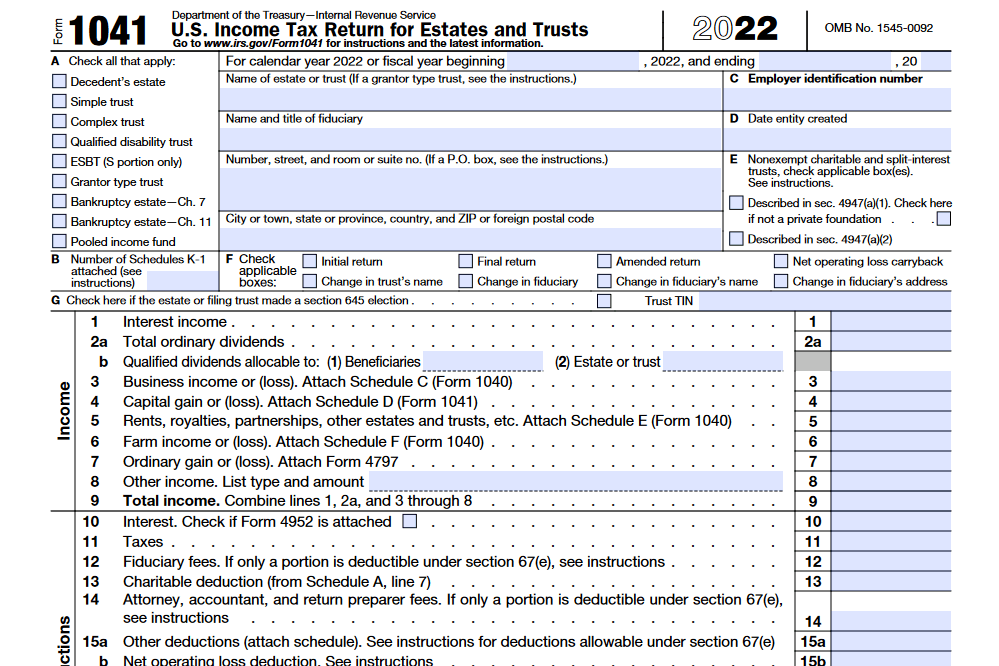

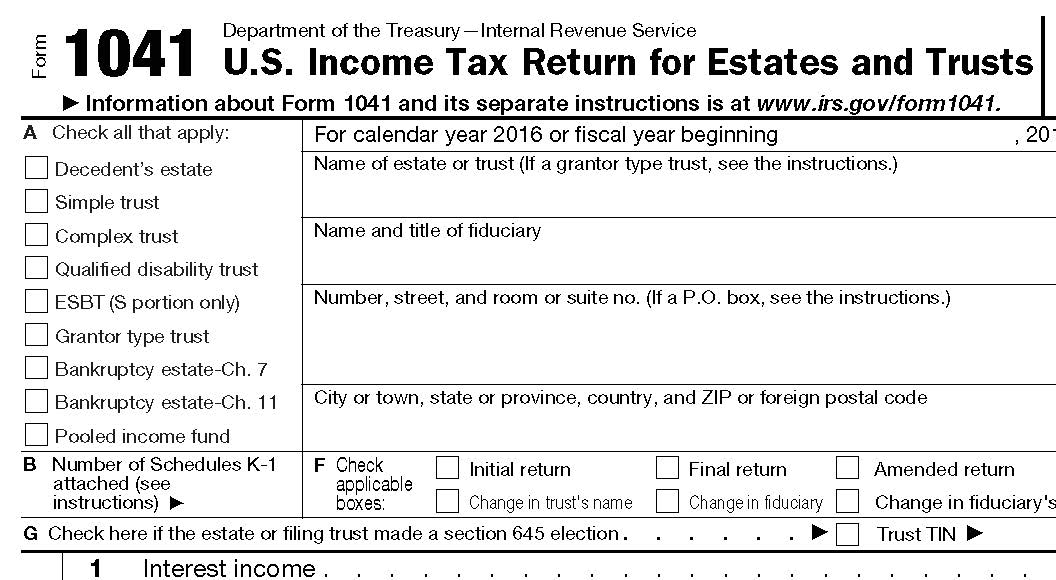

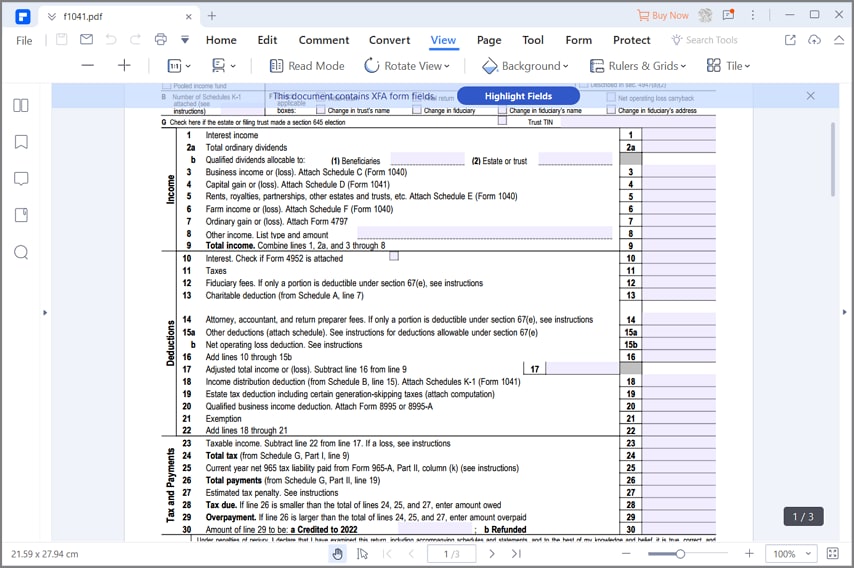

Due Date Of Form 1041 - Of a domestic estate or trust. 13 rows only about one in twelve estate income tax returns are due on april 15! You have 10 calendar days after the. Please note that the irs notice cp 575 b that assigns an. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc.

You have 10 calendar days after the. Please note that the irs notice cp 575 b that assigns an. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Of a domestic estate or trust. 13 rows only about one in twelve estate income tax returns are due on april 15!

Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. 13 rows only about one in twelve estate income tax returns are due on april 15! Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Please note that the irs notice cp 575 b that assigns an. Of a domestic estate or trust. You have 10 calendar days after the.

2019 form 1041 Fill out & sign online DocHub

For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. You have 10 calendar days after the. Of a domestic estate or trust. 13 rows only about one.

1041 Due Date

Please note that the irs notice cp 575 b that assigns an. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax.

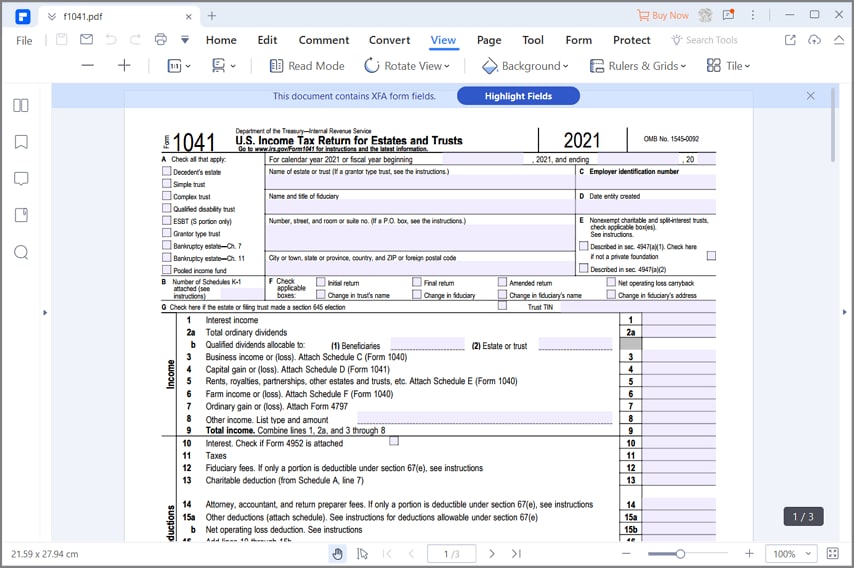

Form 1041 2023 Printable Forms Free Online

13 rows only about one in twelve estate income tax returns are due on april 15! Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. For.

1041 Due Date

Of a domestic estate or trust. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. You have 10 calendar days after the. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. 13 rows only about one.

2023 Form 1041 Due Date Printable Forms Free Online

13 rows only about one in twelve estate income tax returns are due on april 15! For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Please note that the irs notice cp 575 b that assigns an. Learn about form 1041, which is used by.

The Form 1041 Due Date Is Soon! Here's What to Know. Pacific Tax

Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Please note that the irs notice cp 575 b that assigns.

Form 1041 U.S. Tax Return for Estates and Trusts

13 rows only about one in twelve estate income tax returns are due on april 15! Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the.

Estate Tax Return When is it due?

For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. You have 10 calendar days after the. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. Estates or trusts must file form 1041 by the fifteenth day.

2023 Form 1041 Instructions Printable Forms Free Online

Please note that the irs notice cp 575 b that assigns an. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. Of a domestic estate or.

Form 1041 Extension Due Date 2019 justgoing 2020

Of a domestic estate or trust. Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. 13 rows only about one in twelve estate income tax returns are due on april 15! You have 10 calendar days after the. Please note that the irs notice cp 575 b that assigns an.

Please Note That The Irs Notice Cp 575 B That Assigns An.

Learn about form 1041, which is used by a fiduciary to report the income, deductions, gains, losses, etc. 13 rows only about one in twelve estate income tax returns are due on april 15! Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Of a domestic estate or trust.

For Fiscal Year Estates And Trusts, File Form 1041 By The 15Th Day Of The 4Th Month Following The Close Of The Tax Year.

You have 10 calendar days after the.