Form 8300 Letter To Customer - The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you.

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you.

The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you.

Form 8300 Letter To Customer Sample Letter Hub

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

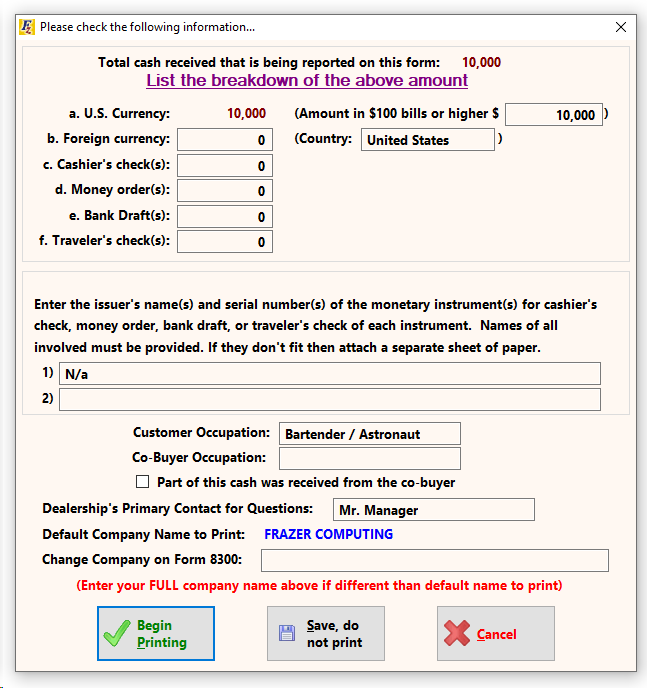

Customers > C1 Customer Activity > Customer Processing > Customer

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form.

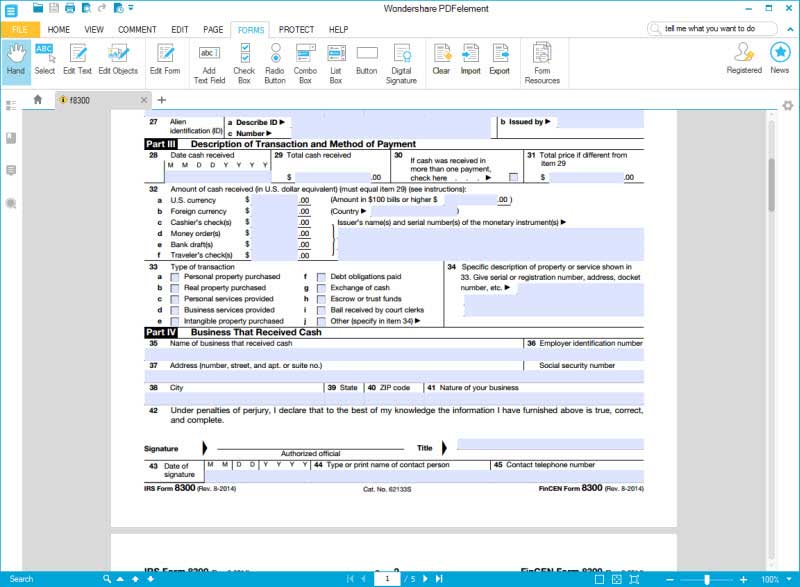

IRS Form 8300 Fill it in a Smart Way

The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that.

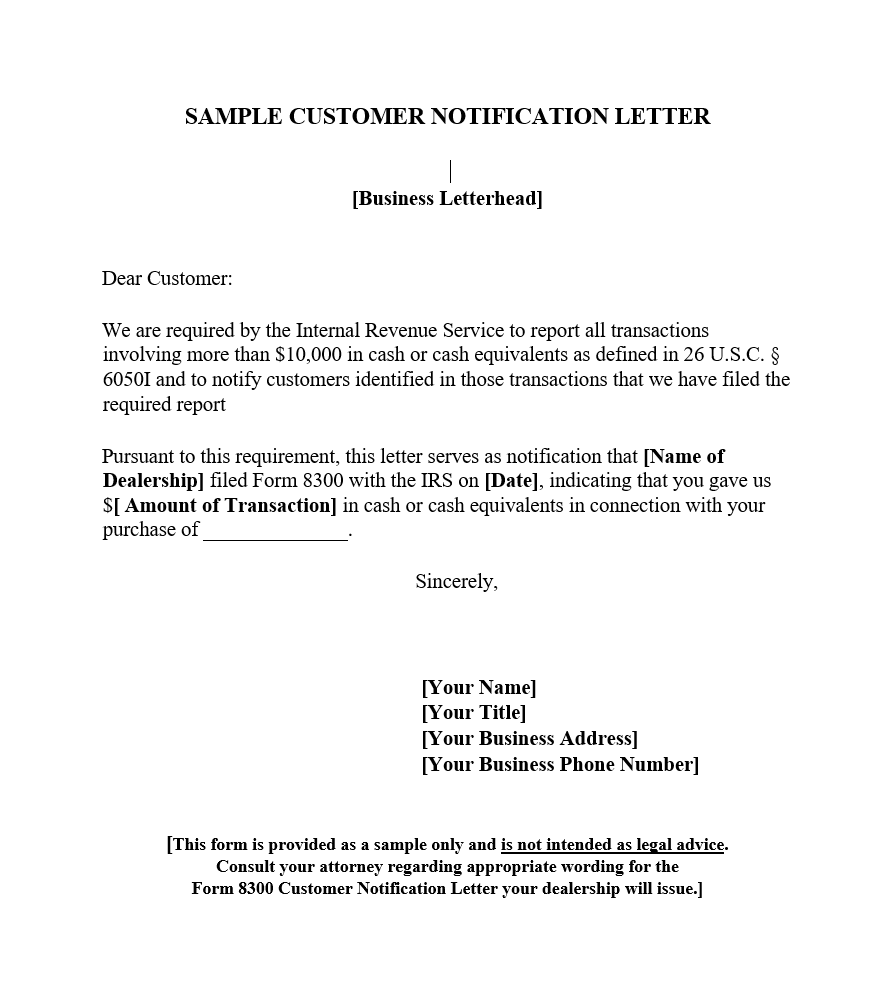

Customer Notification Letter form 8300 Forms Docs 2023

The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

Sample EForms

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. The business filing form 8300 must provide its identified customers and.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300.

Form 8300 Letter to Customer Letter Draft

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. The business filing form 8300 must provide its identified customers and.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Click here for a sample letter that the dealership can use.

How to Fill in IRS Form 8300 For Cash Payments in a Business YouTube

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Click here for a sample letter that the dealership can.

Irs Form 8300 Printable Printable Forms Free Online

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name.

Click Here For A Sample Letter That The Dealership Can Use To Notify The Customer Of The Form 8300 Reporting.

The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you.