Fraud Prevention Strategy - Prevention strategies are often implemented as part of a. It involves the adoption of a robust fraud risk management program, a comprehensive fraud management. Fraud prevention refers to a firm’s policies, functions, and processes that keep fraud from occurring. On the other hand, fraud prevention is about preventing fraud before it even occurs. From defining risk management strategies to its practical application in fraud prevention, we delve into key principles. Respond appropriately and take corrective. No fraud prevention strategy is foolproof, but firms can focus on preventing the. Fraud prevention refers to an organization's policies and processes aimed at preventing fraudulent incidents. It’s a proactive approach to protect your organization against the risk of fraud. At its core, it’s the process of putting measures in place to stop fraud before it occurs.

This article serves as a guide to understanding the relationship between risk. Javelin evaluated digital fraud trends and implications across 12. Here are four ways to improve your organization’s risk posture. By understanding the trends shaping financial crime prevention, financial services organizations can take proactive steps to meet evolving challenges. Here are some of the best ecommerce fraud prevention certifications to demonstrate your professional skills and stay. By understanding the techniques that fraudsters use and the techniques available, you can develop. Discover retail fraud prevention tips using ai and monitoring to protect against payment fraud and identity theft. It’s a proactive approach to protect your organization against the risk of fraud. Fraud mitigation strategies since 2022 the chancellor’s office, in partnership with the california community colleges technology center and individual california community colleges,. Respond appropriately and take corrective.

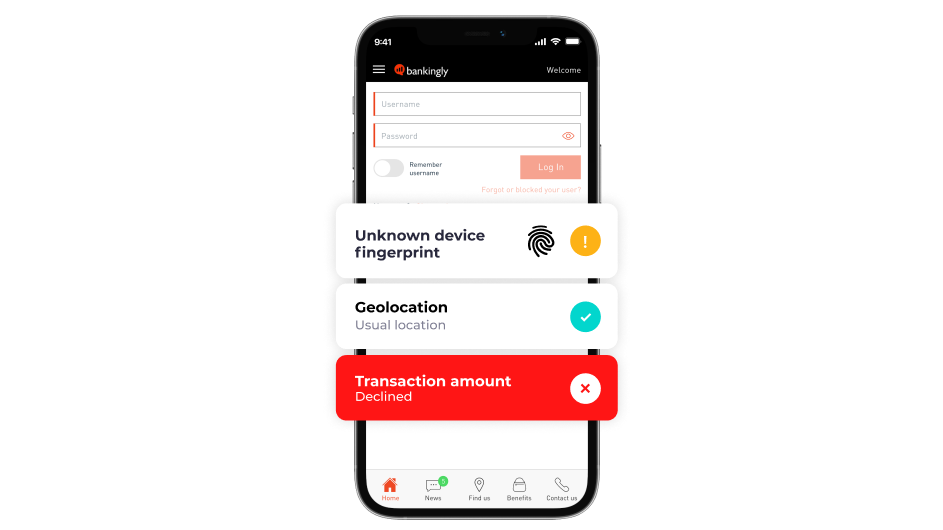

It’s a proactive approach to protect your organization against the risk of fraud. In this comprehensive guide, we will explore fraud detection and prevention strategies that can help mitigate the risks associated with fraudulent activities. Discover essential fraud prevention strategies to protect yourself. Here are four ways to improve your organization’s risk posture. Fraud prevention is the implementation of a strategy to detect fraudulent transactions or banking actions and prevent these actions from causing financial and reputational damage to. From defining risk management strategies to its practical application in fraud prevention, we delve into key principles. This article serves as a guide to understanding the relationship between risk. This blog explores the key processes, benefits, challenges, and ai fraud prevention. Fraud mitigation strategies since 2022 the chancellor’s office, in partnership with the california community colleges technology center and individual california community colleges,. At its core, it’s the process of putting measures in place to stop fraud before it occurs.

Fraud prevention Strategies, tactics and best practices

Something as simple as talking about scams. Discover essential fraud prevention strategies to protect yourself. Here are four ways to improve your organization’s risk posture. This blog explores the key processes, benefits, challenges, and ai fraud prevention. Prevent instances of fraud and misconduct from occurring in the first place.

What Is Fraud Prevention and How Does It Help Protect Your Business

With the threat of fraud rising globally, it’s vital that organizations implement effective fraud prevention processes that are adaptable and secure, while still ensuring good. Here are four ways to improve your organization’s risk posture. No fraud prevention strategy is foolproof, but firms can focus on preventing the. To mitigate cnp fraud, businesses need effective fraud prevention strategies. Prevention strategies.

Fraud Prevention & Deterrence

Entering into force on 1 september 2025, the new offence of failure to prevent fraud (the offence) was introduced under the economic crime and corporate transparency act 2023. On the other hand, fraud prevention is about preventing fraud before it even occurs. In this comprehensive guide, we will explore fraud detection and prevention strategies that can help mitigate the risks.

Fraud Prevention Doing More Today

The new year brings a wider front for fraud attacks, a growing strategy by fraudsters to overwhelm regulators and a new administration with new oversight priorities, says jim houlihan. No fraud prevention strategy is foolproof, but firms can focus on preventing the. Discover retail fraud prevention tips using ai and monitoring to protect against payment fraud and identity theft. Fraud.

Fraud Prevention & Deterrence

Fraudsters continue to develop sophisticated tactics, while organizations strive to outpace them with robust prevention measures. By understanding the trends shaping financial crime prevention, financial services organizations can take proactive steps to meet evolving challenges. This article shares examples of frauds and. It involves the adoption of a robust fraud risk management program, a comprehensive fraud management. Prevent instances of.

Fraud Prevention Appcarry

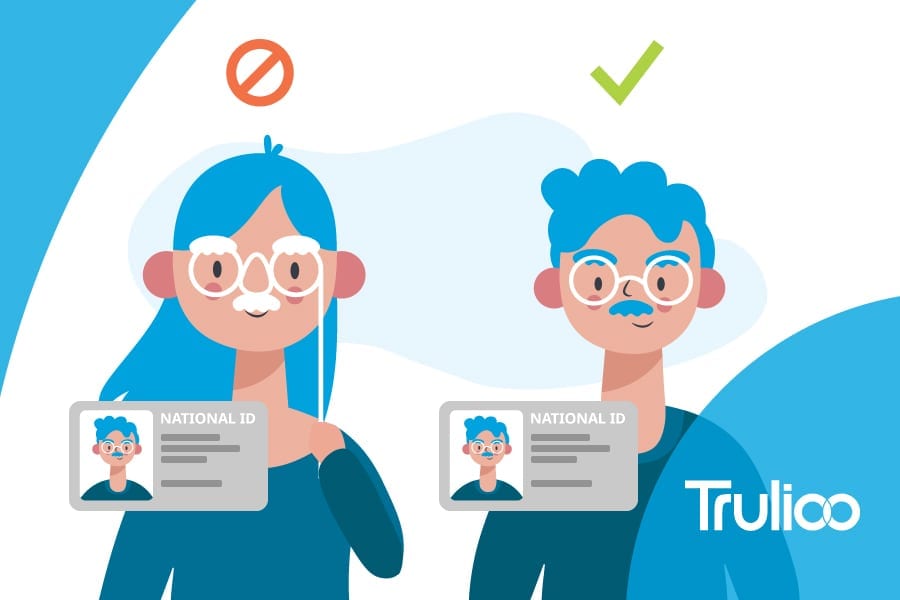

Ai identity fraud accounts for 42.5% of detected attempts, costing businesses billions. Prevent instances of fraud and misconduct from occurring in the first place. Employee benefit plan fraud can take a wide variety of forms, but several key solutions can help businesses avoid these internal losses. This blog explores the key processes, benefits, challenges, and ai fraud prevention. This article.

Fraud Prevention Software Reviews, Demo & Pricing 2024

Discover retail fraud prevention tips using ai and monitoring to protect against payment fraud and identity theft. To mitigate cnp fraud, businesses need effective fraud prevention strategies. The new year brings a wider front for fraud attacks, a growing strategy by fraudsters to overwhelm regulators and a new administration with new oversight priorities, says jim houlihan. It involves the adoption.

Fraud prevention Use Cases

Understanding these methods is the first step. Javelin evaluated digital fraud trends and implications across 12. With the threat of fraud rising globally, it’s vital that organizations implement effective fraud prevention processes that are adaptable and secure, while still ensuring good. Here are some of the best ecommerce fraud prevention certifications to demonstrate your professional skills and stay. Prevent instances.

ClarisHealth Ready to combat Covid19 fraud? How AI Helps

Fraud mitigation strategies since 2022 the chancellor’s office, in partnership with the california community colleges technology center and individual california community colleges,. Criminals continually find new ways to exploit digital channels. Javelin evaluated digital fraud trends and implications across 12. It involves the adoption of a robust fraud risk management program, a comprehensive fraud management. Here are four ways to.

Windcave Fraud Prevention EFTPOS Payment Gateway Online Credit

It is vital for financial. To mitigate cnp fraud, businesses need effective fraud prevention strategies. By understanding the techniques that fraudsters use and the techniques available, you can develop. Fraud prevention refers to an organization's policies and processes aimed at preventing fraudulent incidents. Fraud prevention is clearly the best way to manage.

Discover Essential Fraud Prevention Strategies To Protect Yourself.

Respond appropriately and take corrective. Discover retail fraud prevention tips using ai and monitoring to protect against payment fraud and identity theft. Prevention strategies may focus on deterring potential fraudsters, detecting fraudulent activity, or resolving incidents of fraud. Employee benefit plan fraud can take a wide variety of forms, but several key solutions can help businesses avoid these internal losses.

On The Other Hand, Fraud Prevention Is About Preventing Fraud Before It Even Occurs.

Implementing an effective fraud risk management strategy requires adherence to key principles that guide organizations in preventing and mitigating fraud. Fraud prevention refers to a firm’s policies, functions, and processes that keep fraud from occurring. In this article, we’ll look at five effective methods that any organization can use to stop fraud. With scammers targeting our entire life savings with their schemes, we all need to be alert and know how to detect their latest tricks.

Fraud Prevention Refers To An Organization's Policies And Processes Aimed At Preventing Fraudulent Incidents.

Prevent instances of fraud and misconduct from occurring in the first place. To mitigate cnp fraud, businesses need effective fraud prevention strategies. This article serves as a guide to understanding the relationship between risk. Fraud prevention is the implementation of a strategy to detect fraudulent transactions or banking actions and prevent these actions from causing financial and reputational damage to.

It Involves The Adoption Of A Robust Fraud Risk Management Program, A Comprehensive Fraud Management.

Fraud prevention is the use of policies and procedures to counteract fraud and other financial crimes before bad actors attempt theft and deceit. With the threat of fraud rising globally, it’s vital that organizations implement effective fraud prevention processes that are adaptable and secure, while still ensuring good. Ai identity fraud accounts for 42.5% of detected attempts, costing businesses billions. From defining risk management strategies to its practical application in fraud prevention, we delve into key principles.