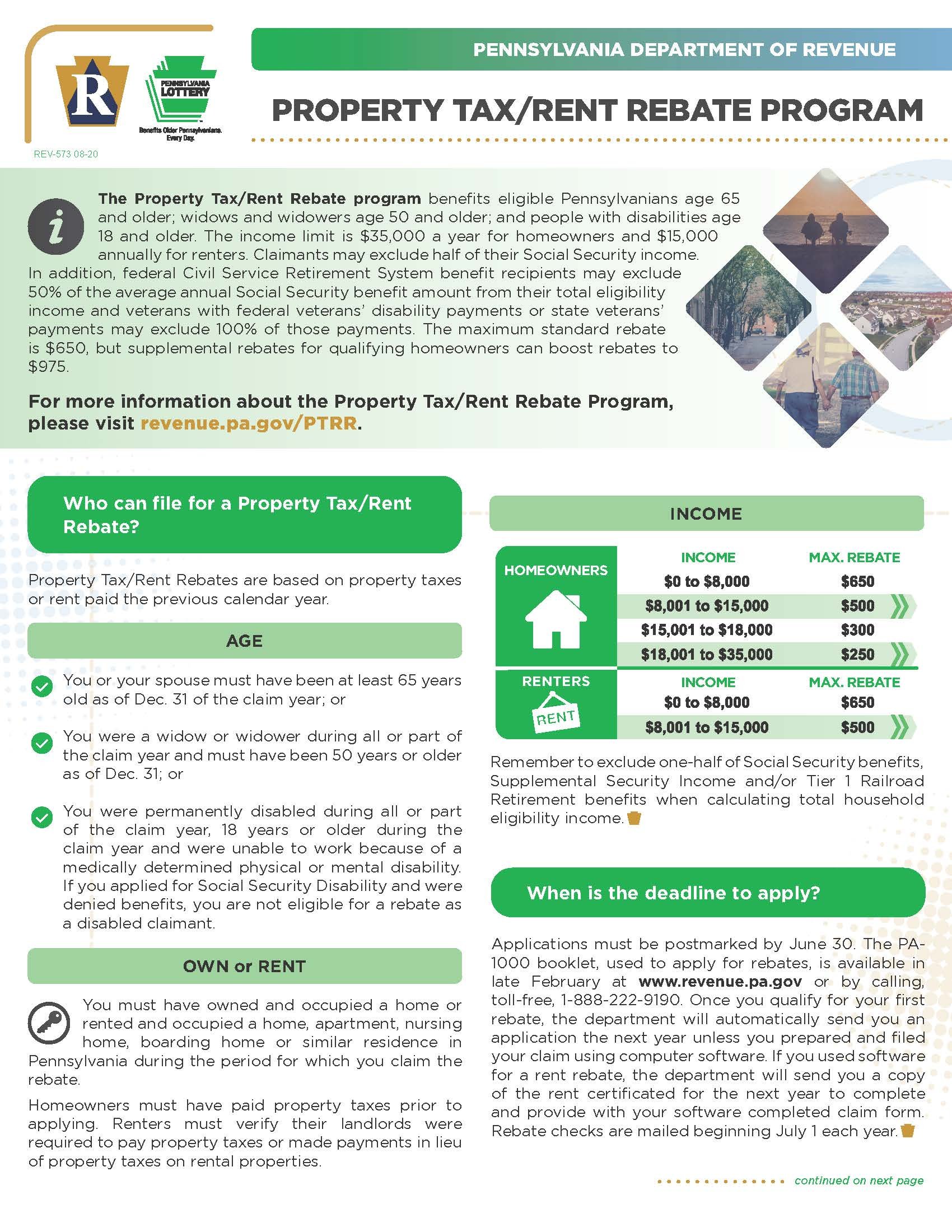

Pa Property Tax Rebate Forms - The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Use this form to apply for the property tax/rent rebate program by mail. Submit all necessary documents, including tax receipts for property. Claimants have the option to electronically apply for a property tax/rent. Renters must make certain their landlords were required to pay property taxes or.

Renters must make certain their landlords were required to pay property taxes or. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Claimants have the option to electronically apply for a property tax/rent. Submit all necessary documents, including tax receipts for property. Use this form to apply for the property tax/rent rebate program by mail.

The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Submit all necessary documents, including tax receipts for property. Renters must make certain their landlords were required to pay property taxes or. Use this form to apply for the property tax/rent rebate program by mail. Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;.

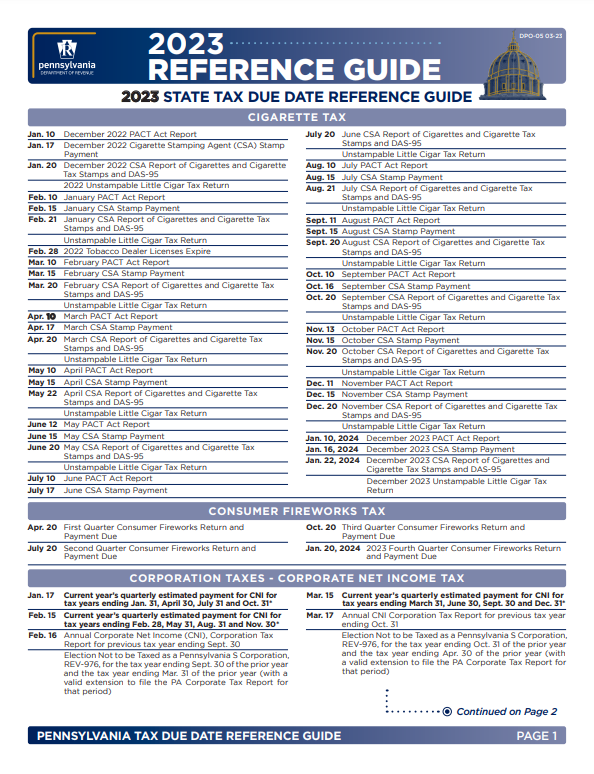

Pa Property Tax Rebate 2024 Application Format Verna Zorine

Submit all necessary documents, including tax receipts for property. The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Claimants have the option to electronically apply for a property tax/rent. Renters must make certain their landlords were required to pay property taxes or.

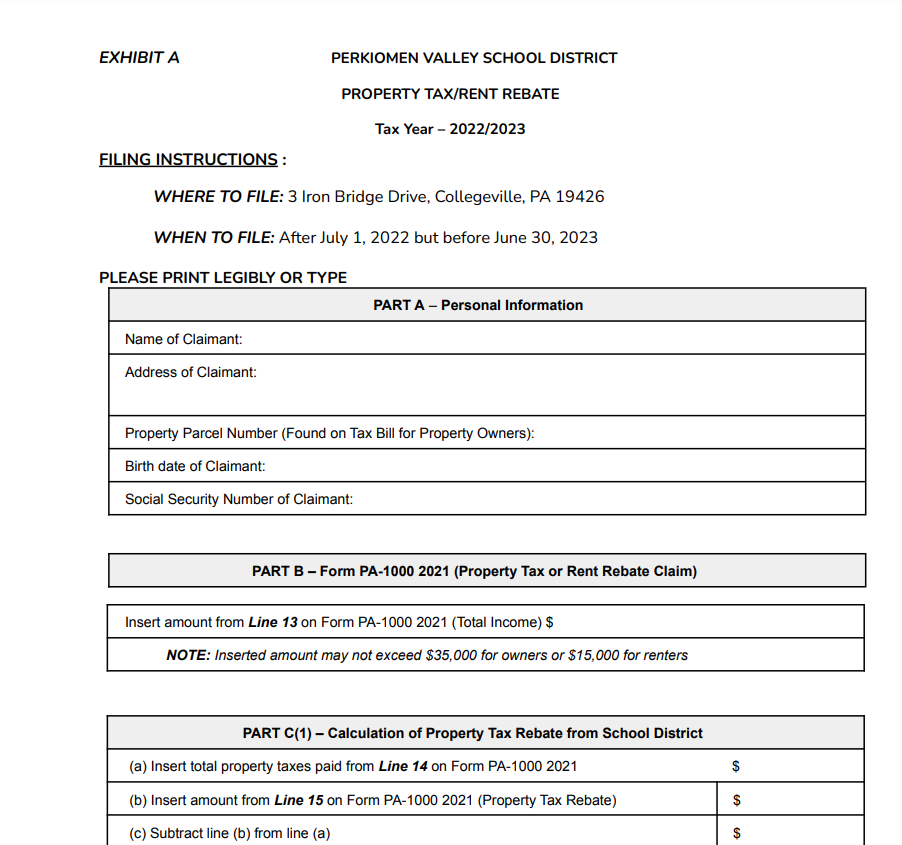

PA Property Tax Rebate Form Printable Rebate Form

Claimants have the option to electronically apply for a property tax/rent. Submit all necessary documents, including tax receipts for property. The maximum standard rebate is $650, but supplemental rebates for qualifying. Renters must make certain their landlords were required to pay property taxes or. The property tax/rent rebate program supports homeowners and renters across pennsylvania.

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Claimants have the option to electronically apply for a property tax/rent. The maximum standard rebate is $650, but supplemental rebates for qualifying. Submit all necessary documents, including tax receipts for property. Renters must make certain their landlords were required to pay property taxes or. The property tax/rent rebate program supports homeowners and renters across pennsylvania.

Pa Property Tax Rebate 2024 Instructions Darby Ellissa

Claimants have the option to electronically apply for a property tax/rent. The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Use this form to apply for the property tax/rent rebate program by mail. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;.

Property Tax Rebate Application printable pdf download

Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Use this form to apply for the property tax/rent rebate program by mail. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Submit all necessary documents, including tax receipts for property.

Pa Property Tax Rebate Forms For 2024 Amelie Steffi

Submit all necessary documents, including tax receipts for property. Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Use this form to apply for the property tax/rent rebate program by mail. Renters must make certain their landlords were required to pay property taxes or.

2022 Pa Property Tax Rebate Forms

Renters must make certain their landlords were required to pay property taxes or. Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Submit all necessary documents, including tax receipts for property. The property tax/rent rebate program supports homeowners and renters across pennsylvania.

Pennsylvania's Property Tax/Rent Rebate Program may help

Use this form to apply for the property tax/rent rebate program by mail. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The maximum standard rebate is $650, but supplemental rebates for qualifying. Renters must make certain their landlords were required to pay property taxes or. Claimants have the option to electronically apply for a property tax/rent.

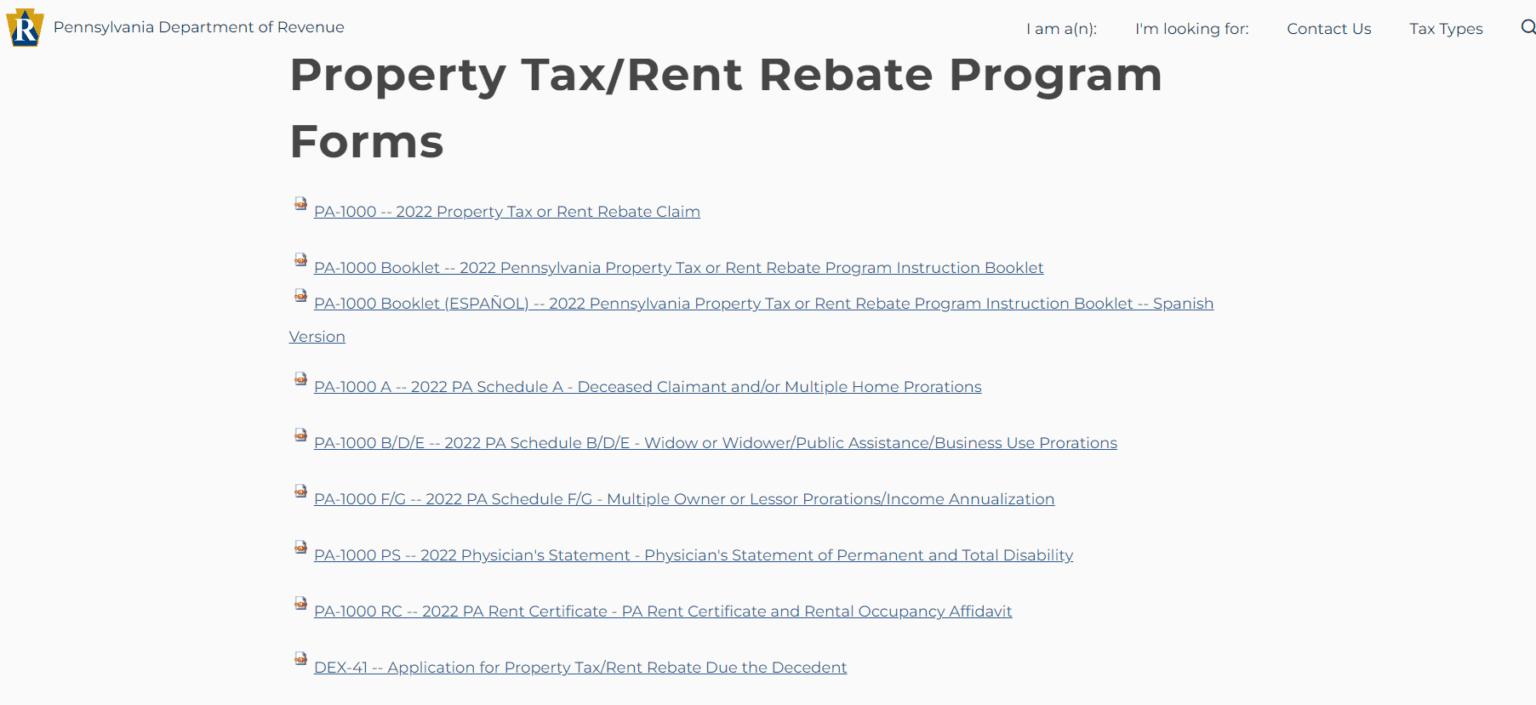

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

The property tax/rent rebate program supports homeowners and renters across pennsylvania. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Renters must make certain their landlords were required to pay property taxes or. Submit all necessary documents, including tax receipts for property. Use this form to apply for the property tax/rent rebate program by mail.

Pa Rent Rebate 2021 Printable Rebate Form

Submit all necessary documents, including tax receipts for property. Use this form to apply for the property tax/rent rebate program by mail. Claimants have the option to electronically apply for a property tax/rent. Renters must make certain their landlords were required to pay property taxes or. The property tax/rent rebate program supports homeowners and renters across pennsylvania.

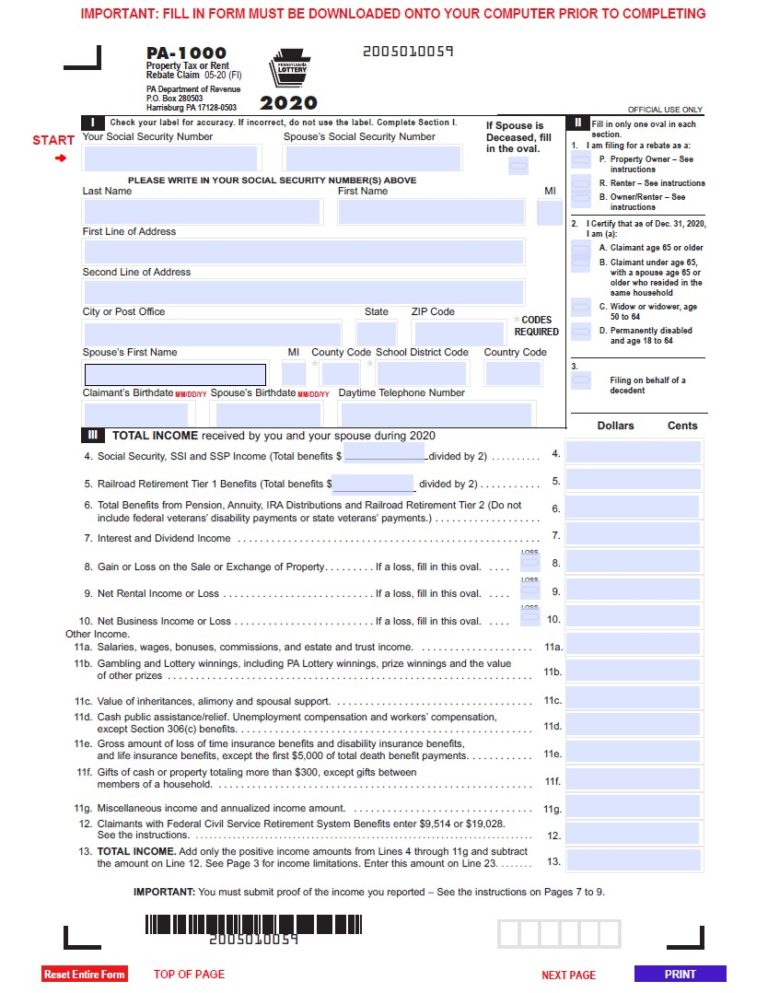

Use This Form To Apply For The Property Tax/Rent Rebate Program By Mail.

Submit all necessary documents, including tax receipts for property. Renters must make certain their landlords were required to pay property taxes or. The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program supports homeowners and renters across pennsylvania.

The Property Tax/Rent Rebate Program Benefits Eligible Pennsylvanians Age 65 And Older;.

Claimants have the option to electronically apply for a property tax/rent.