Reasonable Cause For Late Filing Form 5500 - If you can show reasonable cause for failing to file accurate, timely information. Reasonable cause may be established if the taxpayer shows ignorance of the law in. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. In addition to using the dfvc program, another. Reasonable cause for late filing of form 5500.

Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. Reasonable cause may be established if the taxpayer shows ignorance of the law in. In addition to using the dfvc program, another. If you can show reasonable cause for failing to file accurate, timely information. Reasonable cause for late filing of form 5500.

Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. If you can show reasonable cause for failing to file accurate, timely information. In addition to using the dfvc program, another. Reasonable cause may be established if the taxpayer shows ignorance of the law in. Reasonable cause for late filing of form 5500.

Fillable Online asppa IRS Issues Late Filing Penalty Letters For Form

Reasonable cause for late filing of form 5500. Reasonable cause may be established if the taxpayer shows ignorance of the law in. If you can show reasonable cause for failing to file accurate, timely information. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. In addition to using the dfvc program, another.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

If you can show reasonable cause for failing to file accurate, timely information. Reasonable cause may be established if the taxpayer shows ignorance of the law in. Reasonable cause for late filing of form 5500. In addition to using the dfvc program, another. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to.

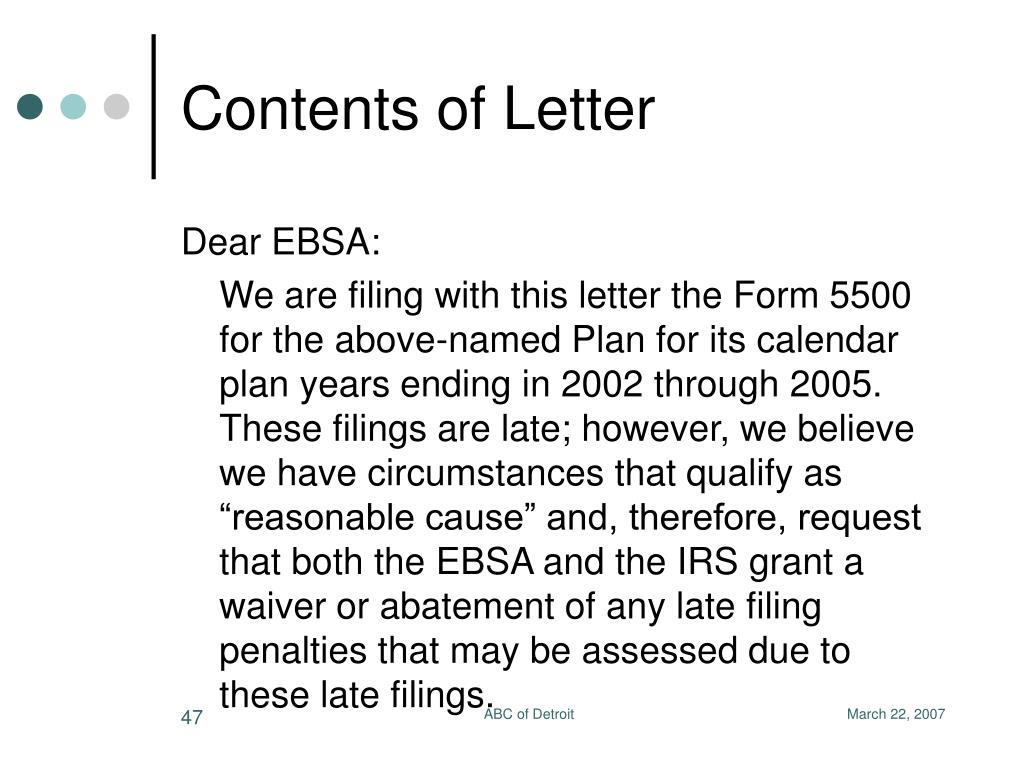

PPT Form 5500 Update PowerPoint Presentation, free download ID1268027

Reasonable cause for late filing of form 5500. In addition to using the dfvc program, another. If you can show reasonable cause for failing to file accurate, timely information. Reasonable cause may be established if the taxpayer shows ignorance of the law in. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to.

Guidelines for Filing Form 5500 Solo 401k plan yearends

Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. Reasonable cause may be established if the taxpayer shows ignorance of the law in. In addition to using the dfvc program, another. Reasonable cause for late filing of form 5500. If you can show reasonable cause for failing to file accurate, timely information.

Health Insurance 5500 Filing Requirements

If you can show reasonable cause for failing to file accurate, timely information. Reasonable cause may be established if the taxpayer shows ignorance of the law in. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. In addition to using the dfvc program, another. Reasonable cause for late filing of form 5500.

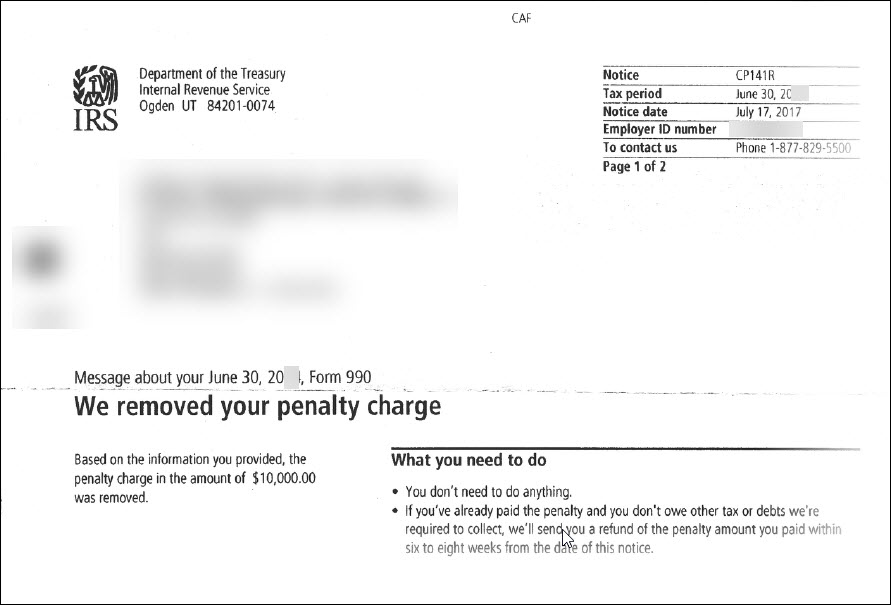

How to Write a Form 990 Late Filing Penalty Abatement Letter

Reasonable cause may be established if the taxpayer shows ignorance of the law in. If you can show reasonable cause for failing to file accurate, timely information. In addition to using the dfvc program, another. Reasonable cause for late filing of form 5500. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to.

Form 2553 A guide to late filing S Corp elections Block Advisors

Reasonable cause for late filing of form 5500. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. Reasonable cause may be established if the taxpayer shows ignorance of the law in. In addition to using the dfvc program, another. If you can show reasonable cause for failing to file accurate, timely information.

Irs Late Filing Reasonable Cause

Reasonable cause may be established if the taxpayer shows ignorance of the law in. If you can show reasonable cause for failing to file accurate, timely information. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. Reasonable cause for late filing of form 5500. In addition to using the dfvc program, another.

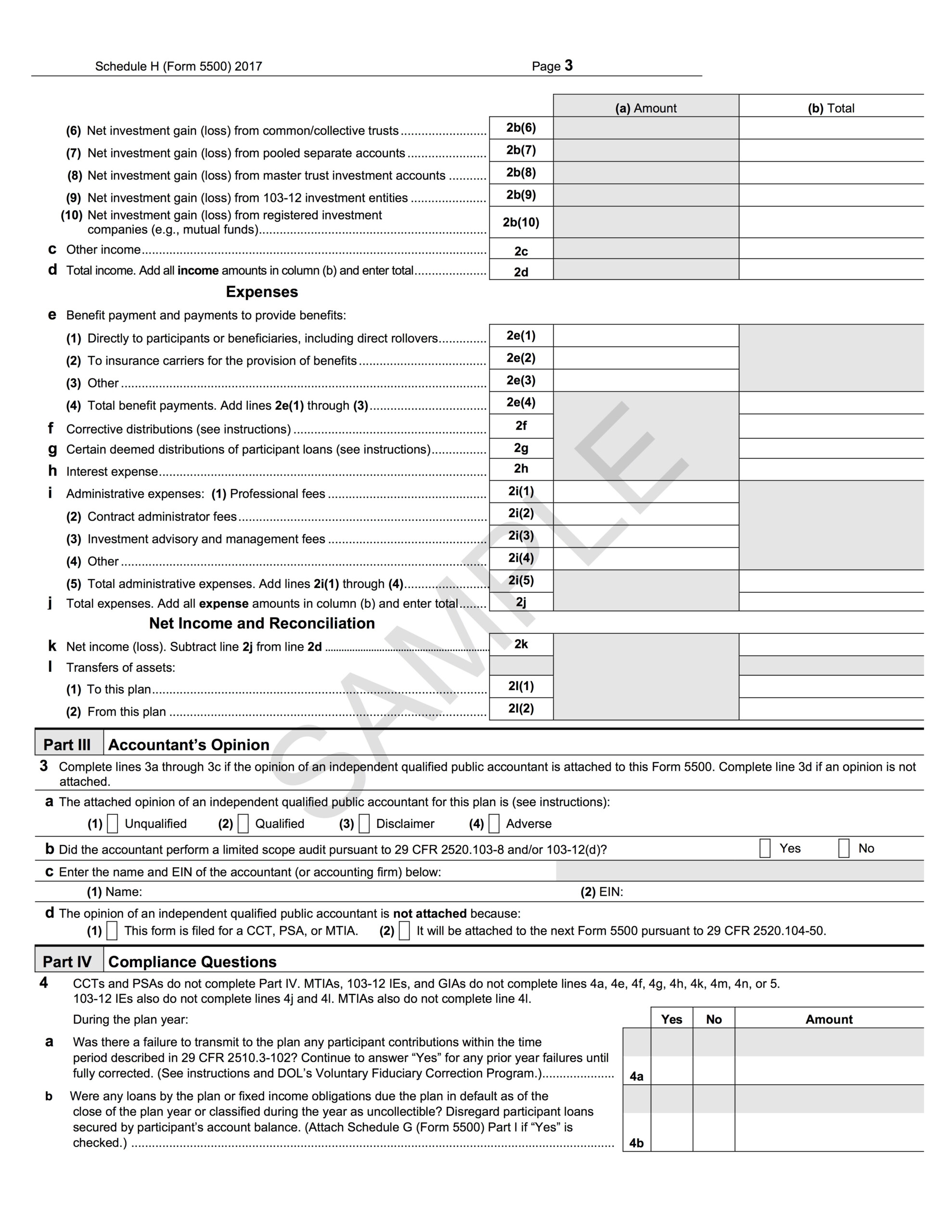

Form 5500 Instructions 5 Steps To Filing Correctly 2023

If you can show reasonable cause for failing to file accurate, timely information. Reasonable cause for late filing of form 5500. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. In addition to using the dfvc program, another. Reasonable cause may be established if the taxpayer shows ignorance of the law in.

PPT Form 5500 Update PowerPoint Presentation, free download ID1268027

Reasonable cause may be established if the taxpayer shows ignorance of the law in. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to. Reasonable cause for late filing of form 5500. In addition to using the dfvc program, another. If you can show reasonable cause for failing to file accurate, timely information.

If You Can Show Reasonable Cause For Failing To File Accurate, Timely Information.

Reasonable cause may be established if the taxpayer shows ignorance of the law in. Reasonable cause for late filing of form 5500. In addition to using the dfvc program, another. Plan sponsors and plan administrators who fail to timely submit a form 5500 may be subject to.