Td Bank Prevent Overdraft Lock - With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace. Learn more about overdraft fees—and how to avoid them. Overdraft protection helps prevent this. When funds are low in your chequing account, overdraft protection covers your payments up to your. An overdraft happens when you make an authorized transaction from your bank. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds.

Learn more about overdraft fees—and how to avoid them. An overdraft happens when you make an authorized transaction from your bank. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. Overdraft protection helps prevent this. When funds are low in your chequing account, overdraft protection covers your payments up to your. With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace.

An overdraft happens when you make an authorized transaction from your bank. Learn more about overdraft fees—and how to avoid them. With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace. Overdraft protection helps prevent this. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. When funds are low in your chequing account, overdraft protection covers your payments up to your.

TD Bank Overdraft Fees, Protection and Limits How To Get Fees Waived

Learn more about overdraft fees—and how to avoid them. When funds are low in your chequing account, overdraft protection covers your payments up to your. An overdraft happens when you make an authorized transaction from your bank. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. Overdraft.

TD Bank to Expand Overdraft Relief Benefits in 2023 TD Stories

Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace. An overdraft happens when you make an authorized transaction from your bank. Overdraft protection helps prevent.

TD Bank Introduces Additional Overdraft Relief for Customers TD Stories

Learn more about overdraft fees—and how to avoid them. With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. Overdraft protection helps prevent this. When funds.

TD Bank Overdraft Limits, Fees and Protection How to Reverse Fees

Overdraft protection helps prevent this. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace. Learn more about overdraft fees—and how to avoid them. An overdraft.

TD Bank Announces Additional Enhancements to Overdraft Policies in 2022

An overdraft happens when you make an authorized transaction from your bank. Learn more about overdraft fees—and how to avoid them. With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace. When funds are low in your chequing account, overdraft protection covers your payments up to your. Overdraft.

Your Saving Grace Overdraft Protection From TD Bank Across America

Learn more about overdraft fees—and how to avoid them. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. An overdraft happens when you make an authorized transaction from your bank. Overdraft protection helps prevent this. With td bank overdraft protection and services, no fees for overdrawing up.

TD Bank Overdraft Limits, Fees and Protection How to Reverse Fees

An overdraft happens when you make an authorized transaction from your bank. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. Learn more about overdraft fees—and how to avoid them. When funds are low in your chequing account, overdraft protection covers your payments up to your. Overdraft.

How Much Can I Overdraft TD Bank? Exploring the Maximum Overdraft Limit

With td bank overdraft protection and services, no fees for overdrawing up to $50, savings overdraft protection, more time with our grace. Overdraft protection helps prevent this. Learn more about overdraft fees—and how to avoid them. When funds are low in your chequing account, overdraft protection covers your payments up to your. Savings overdraft protection is a service that will.

TD Bank Introduces Additional Overdraft Relief for Customers TD Stories

An overdraft happens when you make an authorized transaction from your bank. When funds are low in your chequing account, overdraft protection covers your payments up to your. Learn more about overdraft fees—and how to avoid them. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. Overdraft.

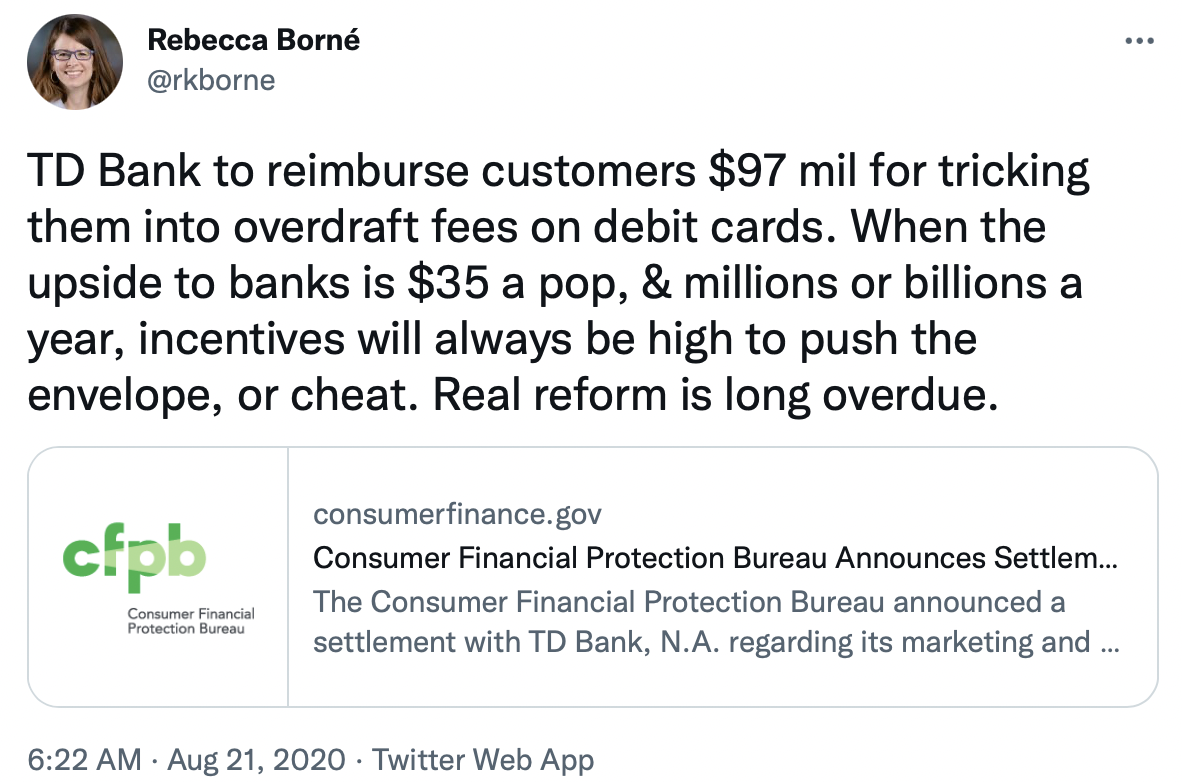

TD Bank 32,225,000 Overdraft Fees Settlement Award Details

Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. Overdraft protection helps prevent this. When funds are low in your chequing account, overdraft protection covers your payments up to your. An overdraft happens when you make an authorized transaction from your bank. Learn more about overdraft fees—and.

An Overdraft Happens When You Make An Authorized Transaction From Your Bank.

When funds are low in your chequing account, overdraft protection covers your payments up to your. Savings overdraft protection is a service that will cover a transaction(s) when funds are unavailable in your checking account by transferring funds. Overdraft protection helps prevent this. Learn more about overdraft fees—and how to avoid them.