Where Is The 199A Deduction Taken On Form 1040 - Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. This deduction propagates from the qbi deduction summary to the 1040 worksheet. It is a business deduction and is. Understanding the § 199a deduction ###. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Where is the § 199a deduction taken on form 1040?

It is a business deduction and is. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Where is the § 199a deduction taken on form 1040? Understanding the § 199a deduction ###. This deduction propagates from the qbi deduction summary to the 1040 worksheet. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates.

Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Understanding the § 199a deduction ###. It is a business deduction and is. This deduction propagates from the qbi deduction summary to the 1040 worksheet. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Where is the § 199a deduction taken on form 1040?

Understanding 199A Deduction (Updated for 2022)

Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Understanding the § 199a deduction ###. This deduction propagates from the qbi deduction summary to the 1040 worksheet. It is a business deduction and is.

Section 199A Qualified Business Deduction WCG CPAs

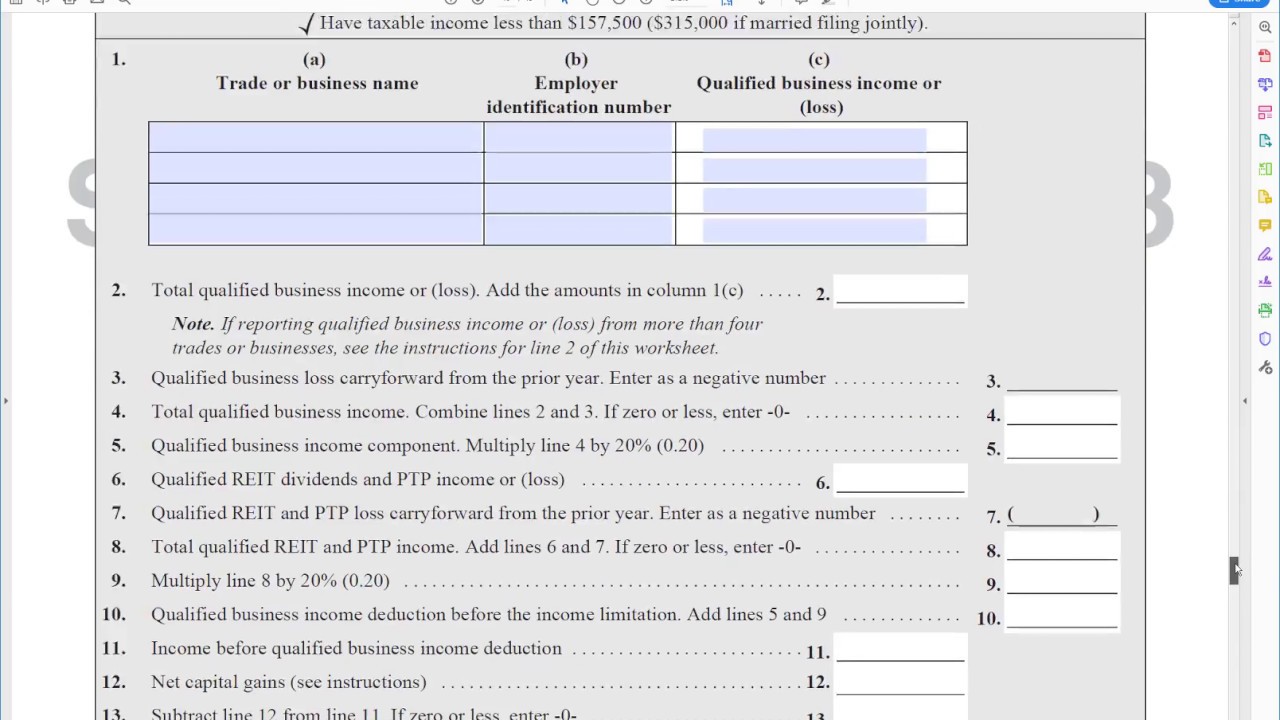

Understanding the § 199a deduction ###. Where is the § 199a deduction taken on form 1040? Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. This deduction propagates from the qbi deduction summary to the 1040 worksheet.

The Accidental CFO The Section 199A Deduction by Chris and Trish Meyer

Where is the § 199a deduction taken on form 1040? Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. This deduction propagates from the qbi deduction summary to the 1040 worksheet. It is a business deduction and is. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates.

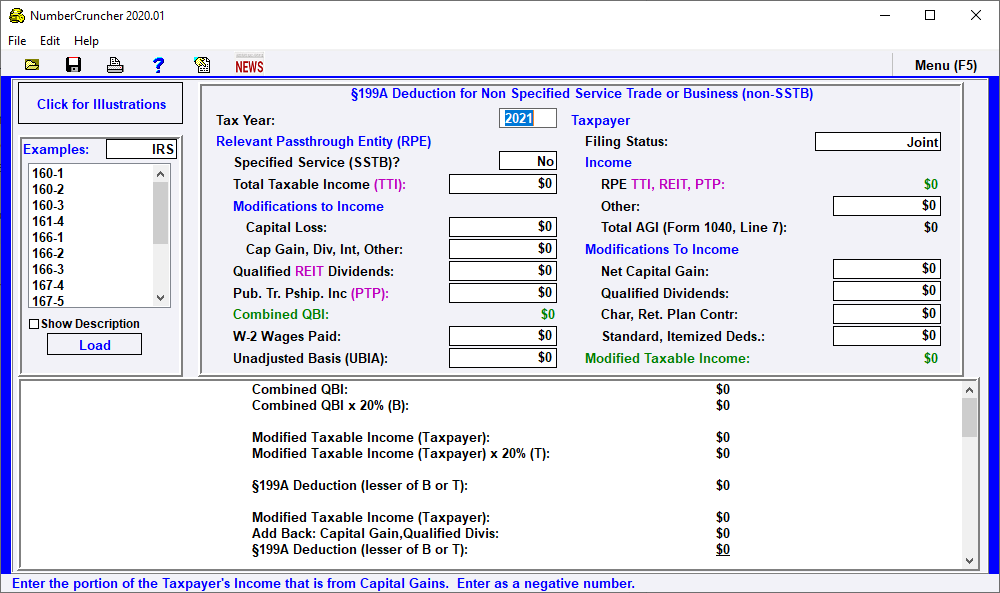

Section 199a Deduction Worksheet Master of Documents

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Where is the § 199a deduction taken on form 1040? It is a business deduction and is. This deduction propagates from the qbi deduction summary to the 1040 worksheet. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates.

Section 199A Deduction 2023 2024

Where is the § 199a deduction taken on form 1040? This deduction propagates from the qbi deduction summary to the 1040 worksheet. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Understanding the § 199a deduction ###. It is a business deduction and is.

Qualified Business Deduction Worksheet

Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Understanding the § 199a deduction ###. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. It is a business deduction and is. This deduction propagates from the qbi deduction summary to the 1040 worksheet.

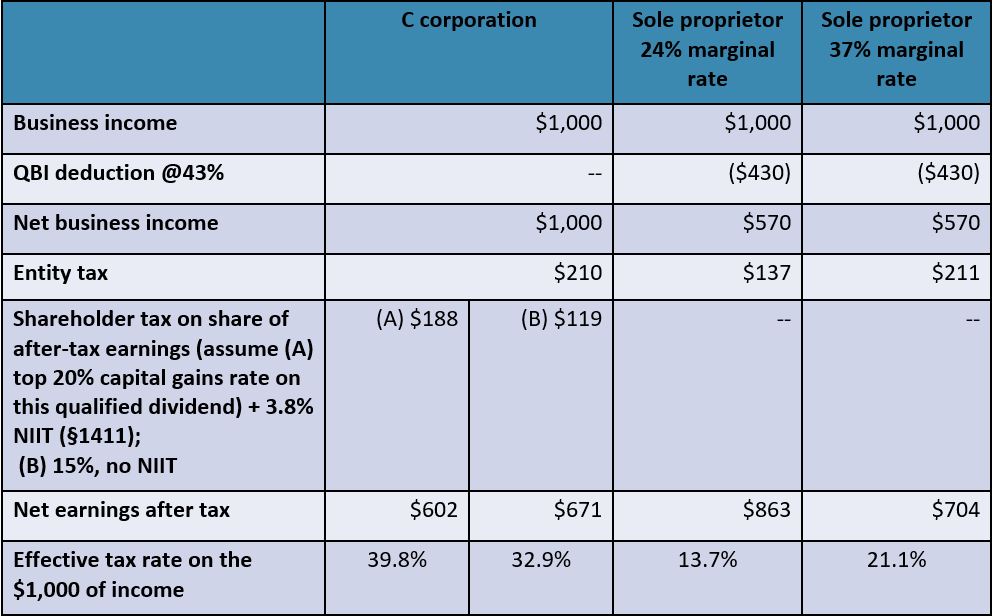

Analysis of a Section 199A Qualified Business Deduction Proposal

Where is the § 199a deduction taken on form 1040? Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. This deduction propagates from the qbi deduction summary to the 1040 worksheet. Understanding the § 199a deduction ###. It is a business deduction and is.

Capture Your 199A Tax Deduction

Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. It is a business deduction and is. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Understanding the § 199a deduction ###. Where is the § 199a deduction taken on form 1040?

Section 199A deduction explained for 2023 QuickBooks

Understanding the § 199a deduction ###. It is a business deduction and is. Where is the § 199a deduction taken on form 1040? Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates.

General §199A General Deduction Leimberg, LeClair, & Lackner, Inc.

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. It is a business deduction and is. This deduction propagates from the qbi deduction summary to the 1040 worksheet. Where is the § 199a deduction taken on form 1040?

This Deduction Propagates From The Qbi Deduction Summary To The 1040 Worksheet.

Understanding the § 199a deduction ###. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. It is a business deduction and is.